Emerging risks could dampen D&O market improvement: Best

- July 16, 2025

- Posted by: Web workers

- Category: Workers Comp

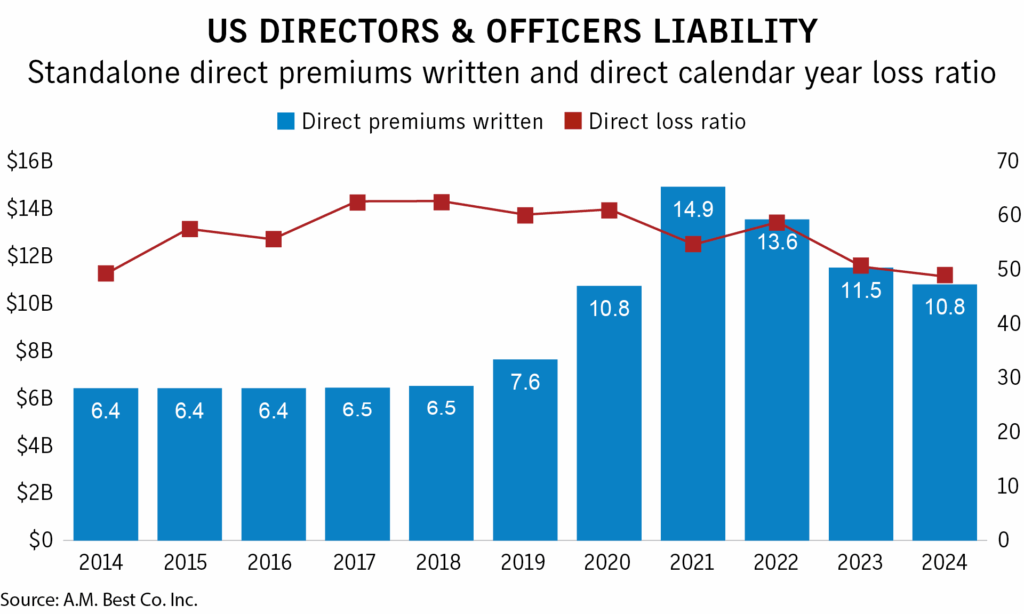

Although the loss ratio for directors and officers liability insurance in 2024 was the most favorable in the last 11 years, emerging risks for underwriters from artificial intelligence and follow-up cyber claims could dampen the market’s continuing improvement, according to a study released Monday by A.M. Best.

Open claims from the competitive soft market from 2015 to 2019 developed adversely in 2024, which could also negatively impact insurers’ profitability, the report said.

D&O market conditions continued to improve last year for insurers with regard to profitability and supply-and-demand dynamics, and buyers are still seeing favorable renewal pricing and competitive market conditions.

The market’s combined ratio in 2024 improved for the second year in a row despite a lower premium base.

Pricing showed signs of stabilization at the end of 2024 as decreases in direct written premiums quarter-to-quarter were smaller than in 2023. While D&O premiums were down overall in 2024, they were lowest in the first quarter as direct written premiums increased in each quarter thereafter.

While there was a slight uptick in special purpose acquisition company activity and initial public offerings in 2024 after a period of significant drop-offs, current economic conditions, such as fluctuations in the stock market and tariffs, could impact these exposures.

Securities class action filings also increased slightly in 2024 to 225, but that was down sharply from the more than 400 filed in 2017 to 2019.