Parametric insurance ‘ubiquitous’: Expert

- October 10, 2025

- Posted by: Web workers

- Category: Workers Comp

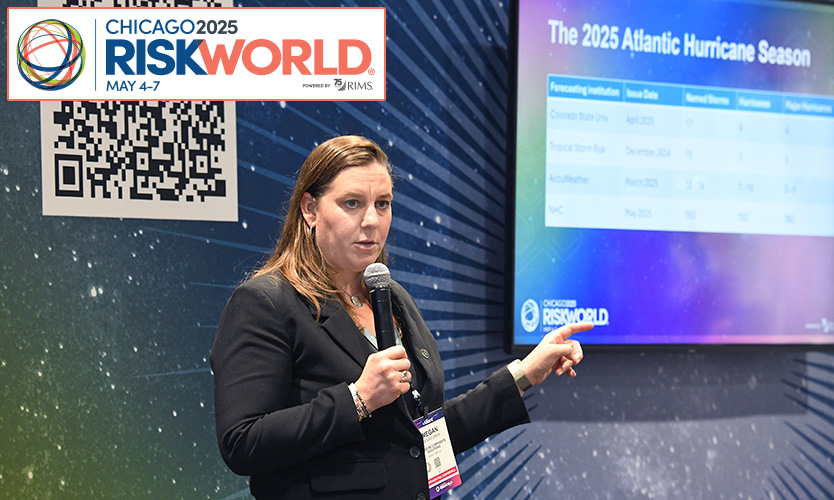

CHICAGO — Parametric insurance has evolved “from the unique to the ubiquitous,” according to Megan Linkin, New York-based expert parametric natural catastrophe structurer for Swiss Re Corporate Solutions, part of Swiss Re Ltd., speaking Monday at the Risk & Insurance Management Society Inc.’s Riskworld conference.

Parametric insurance policies use a specific data point, or “parameter,” such as windspeed or rainfall, to trigger a claim. Such policies are thus reliant on accurate, independent, verifiable data sources.

The founding of the National Weather Service in 1870 and shortly thereafter the United States Geological Survey in 1873 represented first steps in establishing independent, reliable weather data, Ms. Linkin said.

In 1955, the National Hurricane Center was carved out from the National Weather Service as a distinct branch, and in 2014 Hwind, originally a product that was produced by the National Hurricane Center, privatized, giving the insurance industry a robust, third-party data provider on which to base parametric products covering wind and hurricanes.

Each advancement in data science further enabled the evolution of parametric insurance, Ms. Linkin said.

“We went from a time where the weather wasn’t even tracked and we didn’t even know hurricanes were coming, to now being able to cover severe convective storm, hurricane, earthquake and flood, all with parametric insurance,” she said.

This has led to a viable and functioning market that issues policies and pays claims, she said.

“We have paid claims out every year since 2020 and we have settled all of our North American claims in 30 days or less. We have settled some as short as within three days, others within two weeks,” Ms. Linkin said.