Insurance broker M&As down 10% in 2024

- June 10, 2025

- Posted by: Web workers

- Category: Finance

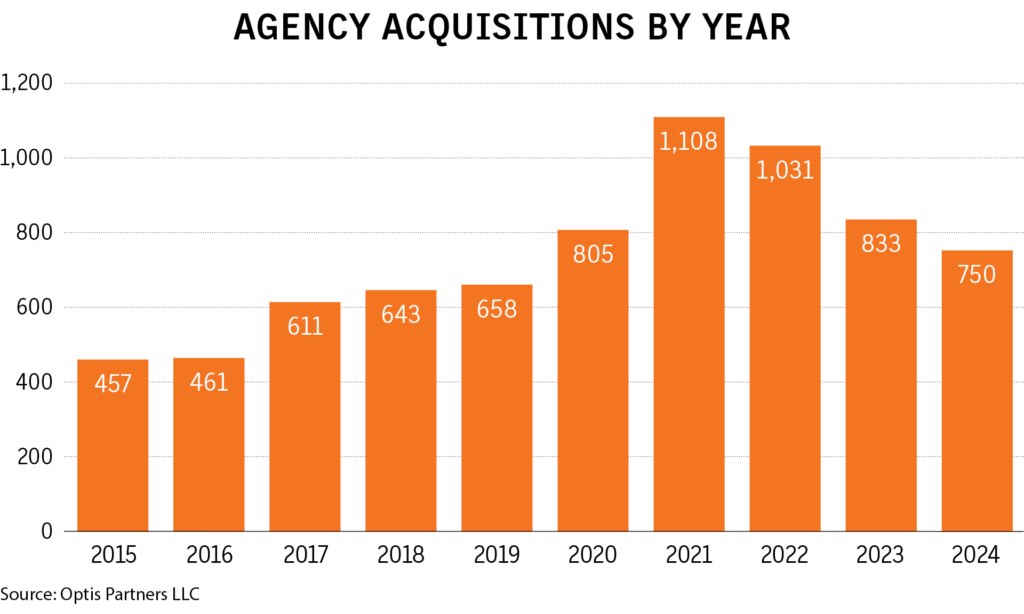

There were 750 insurance agency and brokerage mergers and acquisitions in 2024, down 10% from the 833 reported in 2023. However, three “giant deals” were made during the year, according to a report released Wednesday by Optis Partners LLC.

“There is a general pullback in the pace of acquisition for more than half of the historically most-active buyers,” Steve Germundson, a partner at the Chicago-based investment banking and financial consulting firm, said in a statement.

The eight largest acquirers over the past 10 years – Acrisure LLC; Hub International Ltd.; BroadStreet Partners Inc.; AssuredPartners Inc.; Arthur J. Gallagher & Co.; PCF Insurance Services, which has rebranded as Trucordia; World Insurance Associates LLC; and Alera Group – accounted for 36% of the deals last year. That compares with 42% over the past 10 years, the report said.

In 2024, only BroadStreet, Trucordia and Alera, among the group, reported an increase in deals over 2023, the report said.

Broadstreet was the most active buyer with 90 deals, followed by Hub with 61 and Inszone Insurance Services with 48.

The biggest deals last year were made by the world’s three largest insurance brokerages: Aon PLC’s $13 billion purchase of NFP Corp. in April, Marsh & McLennan Cos. Inc.’s $7.75 billion purchase of McGriff Insurance Services in November, and Gallagher’s $13.45 billion purchase of AssuredPartners, which was announced in December and is expected to close in the current quarter.

“We think there could be some more large deals in the next 12-24 months, though likely not of the magnitude of these three. Nonetheless, the chase for scale continues,” Tim Cunningham, managing partner at Optis, said in the statement.

During the fourth quarter, there were 199 deals announced, down 16% down from the same period in 2023, the report said.