Reinsurance capital for 2024 revised down slightly: A.M. Best

- November 6, 2025

- Posted by: Web workers

- Category: Finance

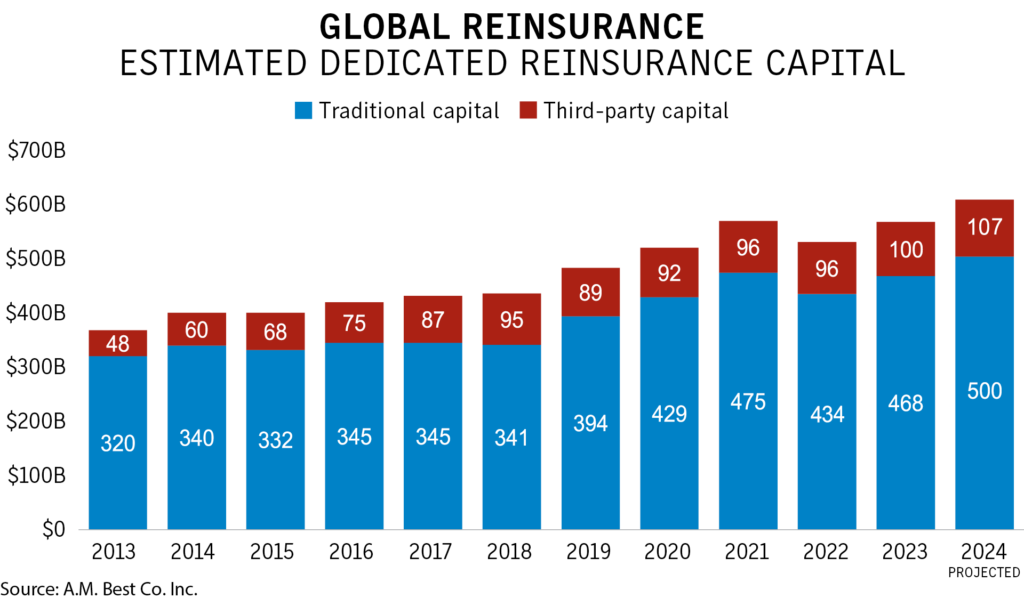

A.M. Best & Co. Wednesday revised its 2024 estimate of traditional reinsurance capital down to $500 billion from $515 billion, which was issued in August 2024.

The downward revision was due primarily to special dividends paid among large reinsurers in the U.S. and Bermuda market and reserve strengthening at year-end to address concerns about reserves by other companies, the ratings agency said in a report Wednesday.

Sitting on top of this is an estimated $107 billion of additional alternative capital, including that from insurance-linked securities, Best said, using estimated figures from Guy Carpenter LLC.

“Since the hardening of the property reinsurance market in 2022, the insurance-linked securities market has continued to evolve into a more significant part of the reinsurance market,” Best said in its report.

At Jan. 1 reinsurance renewals, property reinsurance began to soften, although margins remain strong, Best said, while “casualty has become more scrutinized but is still being renewed without capacity constraints.”

Best went on to say that 2025 would be a “pivotal” year for the reinsurance industry due to the California wildfires and U.S. Southeast winter storms.

“The start of 2025 has again put the industry on alert. The wildfires in California could be the costliest in history, and much uncertainty remains on how programs will respond to them. Had these fires occurred just two weeks earlier, they would probably have had a marked impact on renewals. At the same time, winter storms have plagued the Southeast, further substantiating a heightened level of caution with regard to secondary perils in 2025,” Best said.