Terrorism, political violence markets adjust to different pressures

- October 25, 2025

- Posted by: Web workers

- Category: Finance

Insurance markets for political violence, terrorism and the threat of active assailants have diverged as the risks continue to vex businesses and other organizations, experts say.

The standalone terrorism coverage market is trending softer along with the overall property market, but the political violence sector has seen more claims, so prices are rising.

The market for pure terrorism coverage is softer than in previous years due to added capacity, said Tarique Nageer, terrorism placement and advisory practice leader for Marsh USA Inc. in New York.

Material losses in terrorism lines of coverage have been “very few and far between,” he said, leading more insurers to offer capacity in what has been a profitable line.

This has resulted in softer pricing, off as much as 15% for nonstressed, non-tier one exposures, which include specific areas and zip codes in cities such as New York, Washington and San Francisco, he said.

“There’s a lot of new capacity entering that market, and that new capacity is driving down rates,” said Morgan Shrubb, Atlanta-based head of terrorism North America for Axa XL, a unit of Axa SA.

Existing buyers are in some cases taking advantage of the lower pricing to augment coverage, either by increasing existing limits or purchasing additional coverages, such as active assailant, Mr. Nageer said.

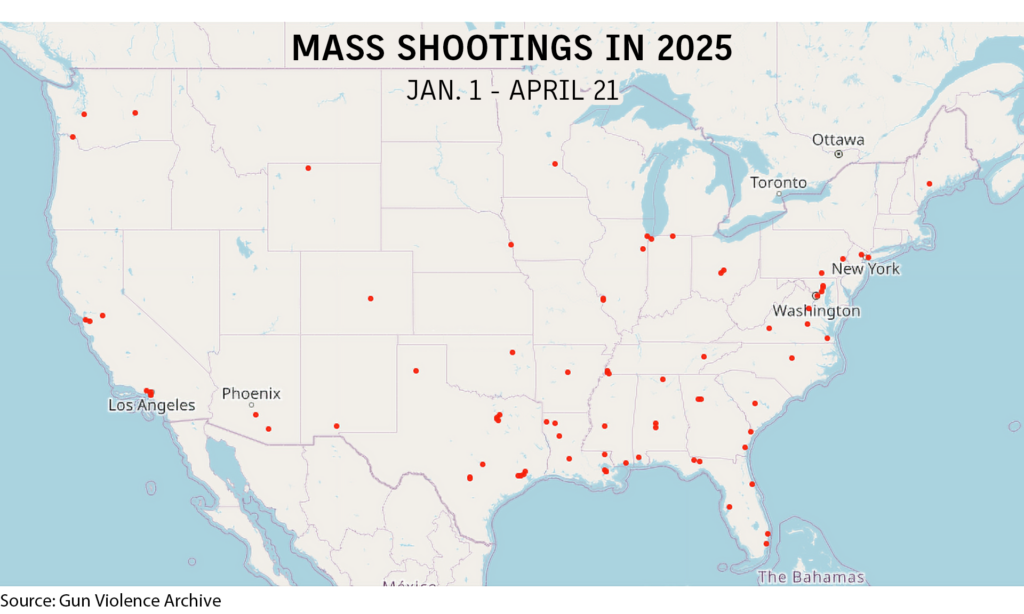

Active assailant products see the most activity in the U.S. as it has more such incidents than other regions, including more than one high-profile assassination attempt leading up to the 2024 election, he said.

Ms. Shrubb said she sees more demand for active assailant insurance than for coverages such as strike, riot and civil commotion, because she sees more U.S clients than her colleagues in London.

“We have more mass shootings here, so more people buy active assailant,” she said, adding that Axa quotes all of its terrorism policies with active assailant coverage.

Such exposures are not lost on many businesses and other organizations that seek to manage the risk, experts say.

“We see that clients have become more risk-averse and are trying to mitigate and remove the geopolitical shocks from their balance sheet,” said Srdjan Todorovic, London-based head of political violence and hostile environment solutions at Allianz Commercial, a division of German insurer Allianz SE.

According to a recent Allianz report, businesses have ranked political risk and violence among the top 10 global risks for the past three years.

Mr. Todorovic said that more clients are buying the coverages, often focused on their property portfolios or even individual assets where they see risk.

The market for political violence coverage, which includes insurance for threats such as insurrection and coups is firmer and claims activity has risen, resulting in price increases of 10% to 25%, he said Mr. Nageer said.

In a March report, Marsh said that “organizations may encounter operational difficulties exacerbated by their exposure to political risks.”

Sources say that pricing for such coverages can vary widely with geography, and that conflict-struck regions such as the Middle East can see different availability and pricing than the U.S. Midwest, for instance, depending on the coverage selected.