Food recalls prompt insurance concerns

- October 11, 2025

- Posted by: Web workers

- Category: Finance

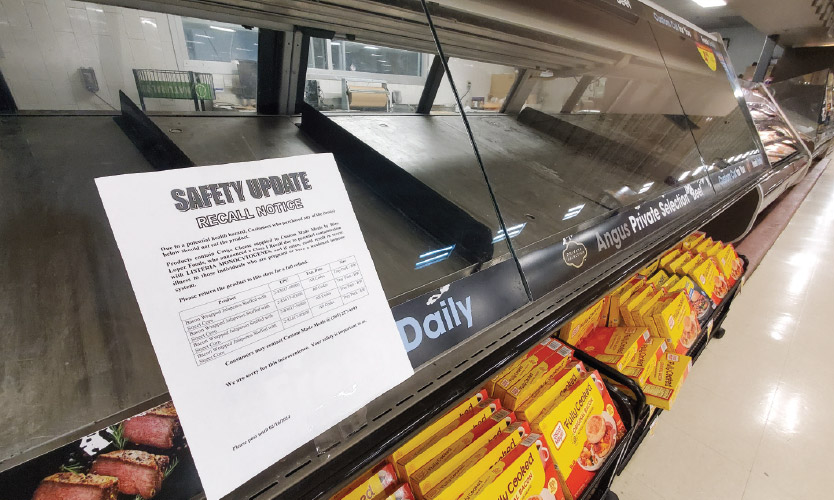

The food recall and contamination insurance market remains stable overall, driven by ample capacity, but recent high-profile recalls, including those linked to brands such as Boar’s Head and McDonald’s, have resulted in higher deductibles and more limited capacity for some food processors, experts say.

Businesses that identify potential contamination issues early and communicate effectively with customers, supply chain partners and regulators can reduce the financial impact of a recall (see related story below).

Regulatory inspections of food plants and restaurants have increased since the pandemic, and social media has heightened awareness of foodborne illnesses, said Glenn Drees, Cincinnati-based managing director at Arthur J. Gallagher & Co.

“Ten years ago, if I went to a restaurant and got sick, my kids might know it, or my wife might know it, but in today’s social media age … information travels much more quickly and more broadly,” he said.

Advances in testing and technology mean issues that previously might have been overlooked are detected earlier, said Chris Harvey, Indianapolis-based senior vice president at Sedgwick Claims Management Services Inc.

“Better technology is catching things that may not have been reported and led to an actual recall,” he said.

“Better technology is catching things that may not have been reported and led to an actual recall,” he said.

The U.S. had 296 food recall announcements in 2024, a 5% decrease from 2023, according to a report issued in February by the Denver-based U.S. Public Interest Research Group Education Fund based on U.S. Food and Drug Administration and U.S. Department of Agriculture data.

While recalls declined, hospitalizations and deaths linked to foodborne illnesses more than doubled in 2024, and 98% of illnesses were attributed to just 13 outbreaks, ranging from cucumbers to deli meat, the report said.

All but one of the 13 outbreaks involved listeria, salmonella or E. coli.

Undeclared allergens were the leading cause of FDA food recalls last year, but food recalls due to bacterial contamination reached their highest level in five years.

Some insurers are becoming more selective about food risks, experts say.

Insurers are limiting capacity and increasing deductibles for high-risk products, making it difficult for some food businesses to secure coverage, said Jeremy Speckman, Cleveland-based risk management advisor at USI Insurance Services.

There’s greater scrutiny of meat and poultry producers, as well as processors of other protein-based foods, such as eggs and leafy greens, Mr. Speckman said. Some liability insurers don’t want to write the business, he said.

General liability or product liability policies typically cover bodily injury and property damage claims arising from foodborne illnesses, while product recall and food contamination policies cover the costs of a recall, including notification expenses and replacement of recalled products.

There’s been an influx of new capacity into the market, which has suppressed any upward rate pressure from claims activity, said Michael Capleton, product recall team leader for CFC Underwriting Ltd. in London.

“If anything, pressure has been slightly downward on rate in the last couple of years. We don’t know if that’s going to change over the next year or so because, obviously, there’s a bit of latency after an increase in claims activity,” Mr. Capleton said.

The recall market remains competitive due to the entry of capacity via managing general agents, but several insurers are reevaluating their capacity and rates, said Natasha McLean, New York-based vice president, national risk practice leader for product recall and contamination for Lockton Cos. LLC.

“A few markets are pushing for some increases because their balance sheets have been impacted by large losses,” such as recent recalls of contaminated peanut butter and Boar’s Head deli meats, Ms. McLean said.

An E. coli outbreak linked to McDonald’s Quarter Pounders led to a recall of slivered onions last October by Taylor Farms, a supplier for McDonald’s. The outbreak sickened 104 people in 14 states, resulting in 34 hospitalizations and one death.

Loss-hit accounts are seeing increases in self-insured retentions and rate increases of 20% to 30%, depending on the circumstances of the recall, she said. Rate increases for loss-free accounts range from 3% to 5%.

Renewal rates for food recall coverage remain competitive, said Jeanna Madlener, Portland, Oregon-based senior vice president, property and casualty, at Woodruff Sawyer & Co. “Despite the big headlines and recall events that we have seen, there’s a lag in the market,” she said.

Large jury verdicts and rising losses are affecting the pricing and availability of umbrella and excess liability coverage, however.

“Food, unfortunately in our business, is sometimes that four-letter word that starts with F,” Ms. Madlener said. “Ten years ago, you could buy a $25 million umbrella, no problem. Now, all of those limits have been restricted, and you’re probably looking at $5 million layers or $10 million unless you’re doing some sort of quota share.”

Rates are up across the board for food risks, ranging from 5% to 10% on general liability and potentially 10% to 15% on lead umbrellas, especially for loss-hit accounts, she said.

Meanwhile, the rising cost of recall events is a concern.

As production facilities have expanded, the severity of food recall claims has increased, Mr. Drees said, adding that business interruption costs associated with cleaning plants have also risen. “We’re seeing more expensive claims,” he said.

Response strategies in focus

Food companies that establish robust communication and response plans will be better prepared to handle recalls, experts say.

Companies are often unprepared for recalls, leading to significant stress and costs, said Peter Gillett, CEO of Marketpoint Recall, a U.K.-based recall and crisis management company.

Having an up-to-date recall plan and access to global communication channels is critical so companies can act quickly to reduce financial and brand reputation damage, he said.

Key preparations include organizing customer data, reserving free phone numbers globally and establishing a trained recall team. Digital techniques like text notifications and digital product passports can further streamline recall processes, Mr. Gillett said.

Establishing a clear communication plan in advance is key, said Glenn Drees, Cincinnati-based managing director at Arthur J. Gallagher & Co.

“If you’re a fast-food restaurant and you’re getting calls that people are getting sick or hospitalized, have a communication plan that is worked out in advance so that you get your message out quickly to the public,” Mr. Drees said.

Most recall policies include a limit that can be used for pre-incident activities, and companies can run tabletop exercises with insurers and other experts, he said.

Companies can differentiate their risk profile by demonstrating effective food safety and crisis communication plans to underwriters, said Jeremy Speckman, Cleveland-based risk management adviser at USI Insurance Services.

CFC offers access to third-party crisis response consultants with policies, said Michael Capleton, product recall team leader for CFC Underwriting Ltd. in London. Consultants guide companies through the recall process and how to mitigate losses, he said.