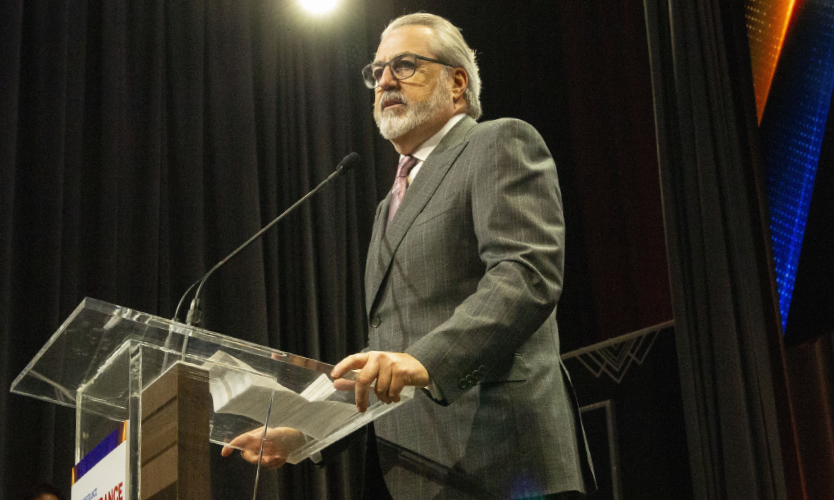

Business Insurance Lifetime Achievement Award: Dave North

- September 12, 2025

- Posted by: Web workers

- Category: Finance

From modest beginnings in the industrial Midwest to building and running the world’s largest third-party administrator, Dave North’s career journey was far from conventional for a top corporate executive.

With a combination of determination, energy and smarts, he transitioned from an Air Force firefighter to a safety professional to an insurance industry sales executive before becoming one of the most well-known leaders in the claims management business.

Along the way, several key experiences — from growing up in a diverse urban neighborhood to being schooled in corporate priorities by a top executive at General Motors — helped form his approach to client service and how to treat and lead his colleagues.

Under Mr. North’s leadership, Sedgwick Claims Management Services Inc. grew from a U.S. TPA with about $50 million in revenue and 5,000 staff to an international claims services organization with about $5 billion in revenue and 30,000 staff.

For his achievements in transforming Sedgwick, his leadership in the industry and his contributions in promoting diversity within the insurance sector, Mr. North received the Business Insurance Lifetime Achievement Award during the U.S. Insurance Awards presentation in New York in July.

Midwest origins

Mr. North was born in the Detroit suburb of Keego Harbor, Michigan, in 1956, where his family operated a fruit and vegetable stand. He lived there until fourth grade when the family moved to Pittsburgh, where other family members lived.

There, they opened “North’s Fruitland” in East Liberty, a black neighborhood in Pittsburgh.

“It wasn’t a big strategic plan to be in an under-represented area, it’s just where the store was, which all turned out great; we were part of the community,” Mr. North said.

During rioting after the April 1968 assassination of Martin Luther King Jr., though, the store was burned, and the family returned to Keego Harbor.

Mr. North said the experience of living in modest circumstances in a black neighborhood helped inform his views on diversity when he became an executive.

“You learn to deal with human beings, and you learn to deal with situations,” he said. “When I got a chance to become a leader, some of the things that people struggle with about diversity or equality or what’s fair in pay and things like that, I never struggled with those. It was clear.”

The family also had a tradition of serving with the local volunteer fire service, which Mr. North followed while still in high school, and when he graduated from high school in 1974, he joined the Air Force to become a fireman. After training at Chanute Air Force Base in Illinois, he was stationed at Dover Air Force Base in Delaware, where he was promoted to sergeant.

In his four years in the service, he obtained a degree in fire protection engineering.

Joining the insurance sector

On leaving the Air Force in 1978, he joined Atlantic Mutual Insurance Co. in Chicago, working in fire safety. After a year, he was recruited to work at Gallagher Bassett Inc., the claims management unit of Arthur J. Gallagher & Co., again working on safety consulting and fire protection.

Working his way up through Gallagher Bassett, he forged a relationship with Jack Campbell, the company’s president. One formative experience was when the pair and their wives were forced to share a condo on a business trip to the Cayman Islands due to overbooking.

“And every morning, in our running shorts, drinking coffee by the kitchen table, I started telling him how I would change the TPA business. It seems a little bold now to say it, but … I was 27 years old and decided I had all the answers,” Mr. North said.

Within a year, he was named director of client services at the company and, from there, continued to move up the ranks, eventually to executive vice president.

“I used to tell everybody I wanted my next job to be a job nobody else ever had. I wanted to fill a need that the company now had that it never had before,” he said.

After 10 years at Gallagher, he was recruited to run Adjustco, a TPA in California. The company was sold after two years, and he then joined brokerage Johnson & Higgins to help develop a self-insurance unit and became involved in its risk management information systems business.

Starting at Sedgwick

In 1995, after five years at J&H, he was recruited to be president of the claims division of Sedgwick PLC, a British brokerage that had bought U.S. broker Fred S. James and was itself later bought by Marsh & McLennan Cos. Inc.

Among the pivotal things in the early years at Sedgwick was pitching to be the TPA for General Motors’ self-administered workers comp program.

“We found out later that of the 16 bidders, 15 of them went in and told them what they would do to make General Motors better, which is a typical sales approach. We went in and said, ‘You’re General Motors, you must be doing a lot of things really well; tell us about those things so we can build a program capturing them, keeping them and adding to them to make you better,’” he said.

Sedgwick won the account and retains it 29 years later.

In one of his first meetings with a senior executive at General Motors, he had another experience that helped shape his approach to business. The executive shared with him a weekly report he sent to the chairman on a single piece of paper and contained one number: the total number of workers not at work for a health-related reason. The number was equivalent to the production output of 13 plants.

“He said, ‘You think it’s complicated, but here’s your job: make that number smaller.’ It became one of those stories that I tell people to help keep them focused,” Mr. North said.

Mr. North has always tried to look at issues through the clients’ lens and think about how the company could help them improve, said Bob Peterson, a retired Sedgwick executive and advisor to the company who worked with Mr. North for more than 25 years.

And Mr. North worked as hard as he expected his fellow executives to work, he said.

“Dave was always very hands-on,” Mr. Peterson said. “He had super high expectations, but it wasn’t just what he expected from others, he worked in the same manner.”

When Marsh McLennan bought Sedgwick in 1998, by which time Mr. North had moved from Chicago to Sedgwick’s headquarters in Memphis, Tennessee, the broker made it clear that the TPA operation was not a priority. A year later, Marsh McLennan began spinning off Sedgwick Claims Management Services Inc. to private-equity owners.

Private equity

By the time of the spin-off, Sedgwick had become a more substantial TPA but remained focused on workers comp claims in the United States.

While private-equity backers sometimes have a reputation for changing companies’ business plans and imposing aggressive growth targets, Mr. North said that was not his experience at Sedgwick.

“Private equity is an amazing capital structure for your business, as long as you do one thing, and that is you do what you say you’re going to do. If you put a set of financial forecasts in front of them that says you’re going to grow X, you don’t have to grow X plus 20%. You just have to grow X. But you have to do that every year,” he said. “So long as you do what you said you were going to do, they are a very hands-off ownership structure.”

Sedgwick, which has had six private-equity owners over the years, embarked on a period of growth after the spin-off that has continued ever since. Among other things, it expanded into the managed care sector, short-term and long-term disability, general, auto and specialty liability, and property loss adjusting; it also expanded internationally to 80 countries.

Much of the expansion was achieved through acquisitions, which began about seven years after the spin-off.

“We acquired small niche businesses to add new capabilities, we added similar claims organizations in geographic areas that we were not in to expand our footprint, and then we acquired some of the largest ones out there to really just expand the scale of the business,” Mr. North said.

The company has completed 60 acquisitions in total, including Specialty Risk Services LLC in 2011, T&H Global Holdings LLC in 2014 and Cunningham Lindsey Group Ltd. in 2018.

Focus on people

Mr. North moved from president and CEO of Sedgwick to executive chairman in 2020 and retired in June of this year, though he remains on the board. Throughout his tenure, he says his prime concern was people.

“If I hired the best people I could find, if I gave them the best work environment I could deliver, if I gave them enough training and encouragement and rope, then they would take care of our customers, and if they took care of our customers, our customers would take care of us,” he said.

Those concerns included maintaining an environment of fairness.

In his early days at Sedgwick, before the spin-off, he was invited to a recognition event in Hawaii for employees and spouses, but as was common at many companies at the time, not unmarried partners or same-sex partners.

“I just felt like in some small way, you go on the trip, you support that policy; you don’t go on a trip, you have a chance to do something about it. And, so, I didn’t go,” he said.

Mr. North was also an early supporter of the Business Insurance Women to Watch program, regularly attending and participating in the conference and funding a book written by a group of honorees.

Looking forward

In his early days in insurance, the industry was defined as brokers and insurers; later, consultants grew more influential, but claims were just the end result, Mr. North said.

“The only reason that the insurance industry exists is when an unexpected financial event occurs to give the corporation some financial protection from that. So, you actually have to have claims for insurance to have value,” he said.

The handling of claims is now a significant part of the insurance ecosystem, Mr. North said.

Looking ahead, amid an era of rapid change, the insurance industry will have to continue to evolve to meet changing needs.

“We are a service industry, and when an individual company forgets that, it will not survive,” he said.

ABOUT THE AWARD

The Business Insurance Lifetime Achievement Award recognizes an individual whose outstanding contributions have had a lasting impact on the insurance and risk management sector. The honorees are also inducted into the Business Insurance Hall of Fame. The award was first presented in 2017 to Patrick G. Ryan, chairman and CEO of Ryan Specialty Holdings Inc. The 2018 honoree was Maurice R. Greenberg, chairman and CEO of C.V. Starr & Co. Inc.; the 2019 honoree was Martin P. Hughes, executive chairman of Hub International Ltd.; the 2020 honoree was Kevin Kelley, retired vice chairman of Liberty Mutual Insurance Co.’s Global Risk Solutions business; the 2021 honoree was Brian Duperreault, who retired as executive chairman of American International Group Inc. later that year; the 2022 honoree was J. Patrick Gallagher Jr., chairman, president and CEO of Arthur J. Gallagher & Co.; and the 2023 honoree was Alan Jay Kaufman, chairman, president and CEO of H.W. Kaufman Group.