Nat cat insured losses up 5% from 10-year average

- September 1, 2025

- Posted by: Web workers

- Category: Finance

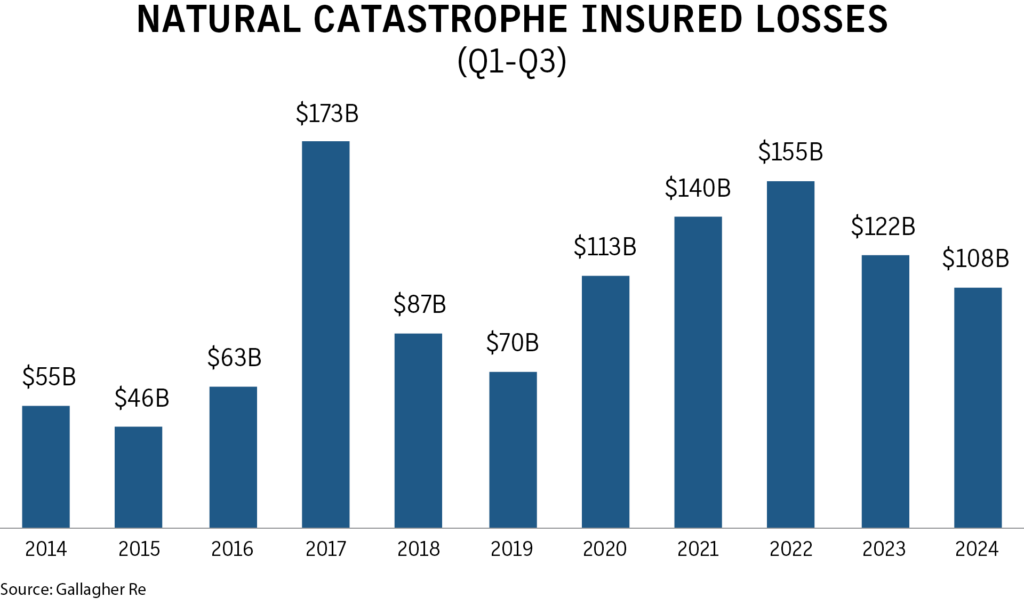

Insured losses from global natural catastrophes totaled at least $108 billion through the first nine months of this year, just 5% higher than the 10-year average of $102 billion, according to a report Wednesday from Gallagher Re, the reinsurance brokerage of Arthur J. Gallagher & Co.

The preliminary estimates do not include insured losses from Hurricane Milton, which made landfall in Florida on Oct. 9.

Public and privately insured natural catastrophe losses for the first nine months were down 11% on the $122 billion recorded in the first nine months of 2023.

The U.S. accounted for more than $77 billion, or 71% of the nine-month insured loss total, above the region’s decadal average of $65 billion.

Hurricane Helene was the costliest industry event through the third quarter, causing insured losses of $10 billion to $15 billion, Gallagher Re said.

Seven of the top 10 costliest insured loss events through the nine-month period occurred in the U.S., including Hurricane Helene. Severe convective storm events accounted for four of the other top 10.

Severe convective storm losses at $57 billion accounted for more than half of the nine-month global total, some $51 billion of which occurred in the U.S.

The U.S. saw at least 15 individual billion-dollar insured severe convective storm events in the first nine months, 11 of which cost more than $2 billion.

Tropical cyclone was the second-costliest peril globally, causing $22 billion in insured losses, and flooding was third at $15 billion.

The Atlantic hurricane season has already seen five hurricane landfalls in the U.S., and favorable conditions should persist through November, Gallagher Re said in the report.