Private-equity investments in insurers tumble from last year

- March 24, 2025

- Posted by: Web workers

- Category: Finance

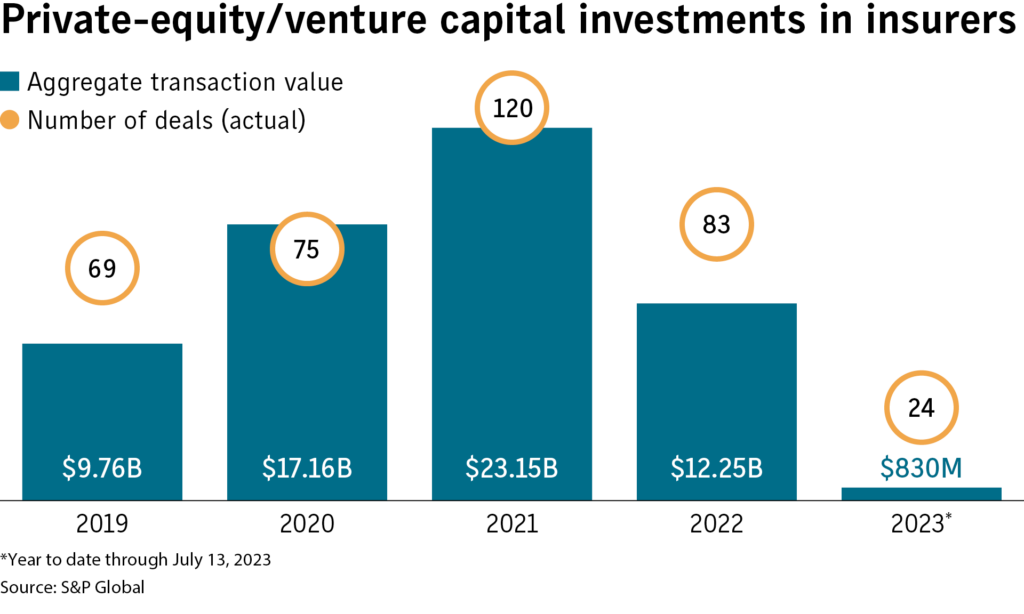

Investments by private-equity companies in insurance underwriting companies rose in the second quarter compared with the first quarter but were significantly down from the same period last year, according to an analysis released Thursday by S&P Global.

Worldwide investments backed by private-equity and venture capital companies in the sector totaled $530 million in the second quarter, up from $270 million in the first quarter, but a 41.1% decrease from the second quarter of 2022, the report said.

The 2022 second-quarter total was less than half the total for the first quarter of last year.

Deal numbers also dropped, with 23 deals in this year’s first half – plus one so far in the third quarter – compared with 45 deals in the first half of 2022.

The largest investment so far in 2023 was in SageSure Insurance Managers LLC, which raised $250 million from Amwins Group Inc., Edwards Capital LLC and Ares Management Corp. in May.

Merger and acquisition activity in the insurance brokerage sector, which is dominated by private-equity firms, has also decreased as interest rates have risen sharply over the past year, increasing borrowing costs for investors.