Lloyd’s platform benefits most attractive for strategic gains, poll suggests

- June 24, 2025

- Posted by: Kassandra Jimenez-Sanchez

- Category: Insurance

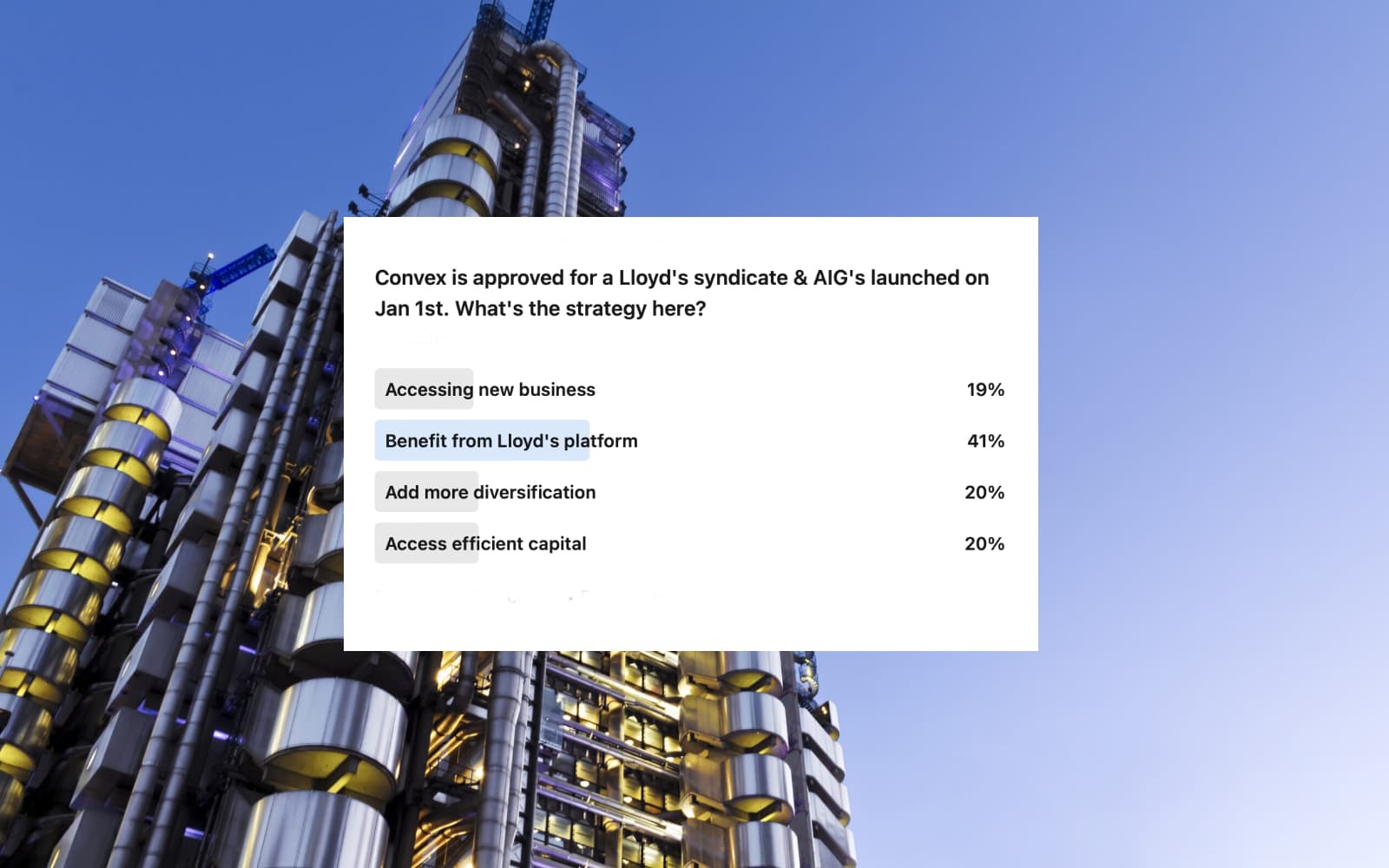

Following Convex Group’s recent approval in principle for syndicate 1984 at Lloyd’s and AIG’s launch of syndicate 2478, we asked our readers their thoughts on the strategic advantages driving these global re/insurers’ ventures into the world’s oldest insurance and reinsurance marketplace.

Most respondents (41%) cited the benefits of the Lloyd’s platform as the primary driver.

Diversification and access to efficient capital tied for second place, each mentioned by 20% of participants. Meanwhile, 19% saw access to new business as the biggest advantage.

In December 2024, AIG announced the launch of Syndicate 2478 at the specialist Lloyd’s marketplace, which will be a multi-year participant on the firm’s outwards reinsurance program.

It started underwriting from January 1st, 2025, and will be managed by Talbot Underwriting Limited at Lloyd’s, with an approved stamp capacity of $715 million for the 2025 Year of Account.

Syndicate 2478 is also supported by third-party capital from funds managed by Blackstone, who will act as investment manager for syndicate assets, via the Lloyd’s London Bridge 2 PCC structure.

Charlie Fry, Executive VP, Reinsurance & Risk Capital Optimization at AIG, stated: “The launch of Syndicate 2478 is a significant endorsement of the quality of our property & casualty underwriting portfolio and demonstrates the strength of our strategic relationships with Blackstone and Lloyd’s – distinct advantages that set AIG apart.”

Convex Group received approval in principle for Syndicate 1984 in February 2024 and anticipates commencing underwriting in April 2025.

Syndicate 1984 will underwrite a portion of Convex’s reinsurance, along with select international business lines, targeting £150 million in gross written premium in 2025.

It will reportedly be led by Jacqueline Wiffen, UK Chief Underwriting Officer for insurance at Convex, as active underwriter.

The selected lines of international business Syndicate 1984 will look to write includes accident & health, casualty, crisis management, ELA (equine, livestock & aquaculture), energy, marine, political risk, and property.

Paul Brand, Convex’s CEO, had previously commented: “Convex is always looking for new opportunities to develop its business both in Bermuda, London and elsewhere.

“Lloyd’s is a core insurance market and part of Convex management’s DNA. Entering Lloyd’s has always been a distinct possibility, and we feel that now is the right time to enter this fantastic marketplace.”

These recent developments reaffirm Lloyd’s enduring appeal as a key strategic platform for global reinsurers seeking diversification, capital efficiency, and new business opportunities.

The market entries of both AIG and Convex further highlight Lloyd’s reputation as a hub for innovation and underwriting excellence.

This website states: The content on this site is sourced from the internet. If there is any infringement, please contact us and we will handle it promptly.