Japan reinsurance renewals to experience increased rate pressure compared to Jan 1, poll reveals

- September 21, 2025

- Posted by: Kassandra Jimenez-Sanchez

- Category: Insurance

Following the January reinsurance renewals, the industry’s focus now shifts to the critical April 1 renewals in Japan, navigating a landscape shaped by recent natural catastrophes and economic uncertainties.

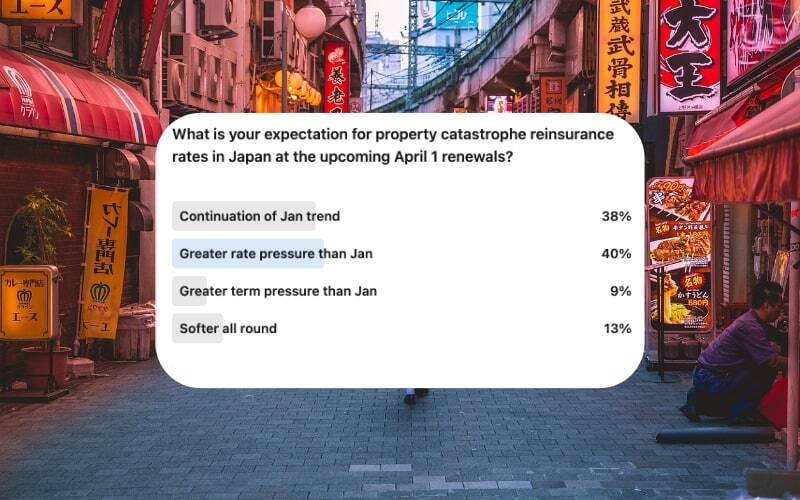

A recent Reinsurance News poll asked readers their market expectations for Japanese property catastrophe reinsurance rates, which revealed a close split.

40% of respondents anticipate increased rate pressure compared to January 1, while 38% foresee a continuation of the 1.1 trend.

Conversely, 13% predict a general softening, and only 9% expect heightened term pressure beyond January levels.

Some overall softening was seen at the January 1st, 2025, reinsurance renewals, and it’s been a particularly costly start to the year with the Los Angeles, California wildfires.

Nat cat activity in Japan has benign relatively benign when compared with the US in recent times, and while the LA wildfire loss is extremely costly for insurers and reinsurers, the consensus is that the event isn’t expected to influence rates at the Japanese renewals, although some market commentary has suggested it could dampen potential softening.

Some experts, like Sven Althoff, Member of the Executive Board for P&C at Hannover Re, expect the renewal rounds for the rest of 2025 to be similar to the January 1st experience, with the market poised to plateau at a high level.

January 1, 2025, renewals saw further rate increases for loss-affected cat business, while loss-free property catastrophe accounts experienced reductions, varying by region and peril.

The April 1st renewal round is heavily focused on Japan, and commenting specifically on the region, Althoff said that he expects to see stable demand and healthy supply, predicting “similar development like we have seen at 1.1, with hopefully pressure on pricing being a little less compared to 1.1, as we had a very significant loss in the industry so early in the year, but there will still be pressure.”

This website states: The content on this site is sourced from the internet. If there is any infringement, please contact us and we will handle it promptly.