Poll suggests re/insurers will target growth in existing lines amid capital build-up

- July 27, 2025

- Posted by: Kane Wells

- Category: Insurance

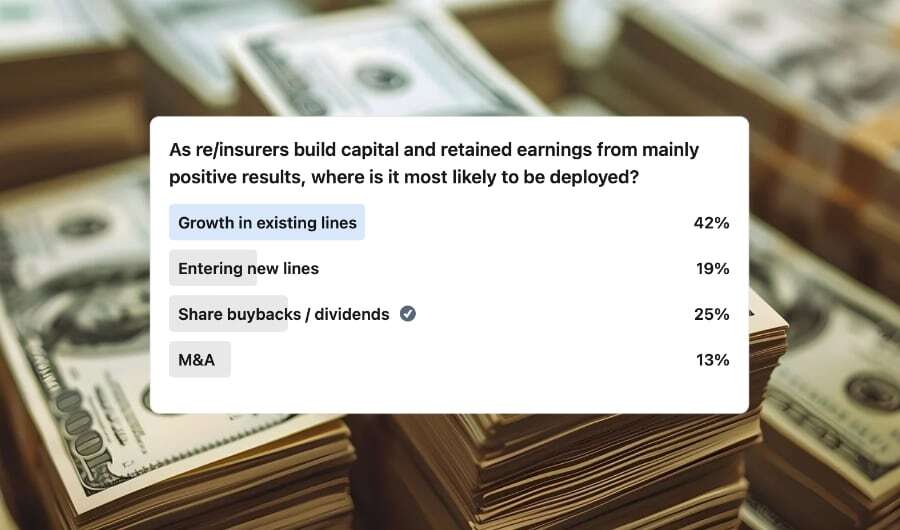

As re/insurers accumulate capital and retain earnings following predominantly positive results, 42% of industry respondents in a recent Reinsurance News poll indicate that growth in existing lines is the most likely area for capital deployment.

This comes as no surprise, given the ongoing favourable market conditions and improved results that have been reported so far in H1. Reinsurers are observably growing, notably in property, which has been described as one of the most advantageous markets in a long time.

Chubb released its Q2 2024 results recently, noting that P&C underwriting income of $1.42 billion with a combined ratio of 86.8%, despite a rise in pre-tax catastrophe losses, net of reinsurance, to $580 million.

At the same time, Munich Re has reported that its reinsurance business contributed €1.3 billion and €3.2 billion to the Group’s net result in Q2 and H1 2024, respectively, and despite a rise in major loss expenditure, the P&C reinsurance combined ratio strengthened.

Meanwhile, Everest, Beazley, RenaissanceRe and Lancashire all experienced positive developments in Q2, with Paul Gregory, CUO of Lancashire, observing, “We see the property reinsurance market as a great place to be, with ample opportunity to write well-priced and structured business.”

Of the remaining voters in our poll, which gathered the opinions of an array of individuals within the re/insurance sector, 25% noted that capital would go to share buybacks/dividends, 19% to entering new lines, and 13% to mergers and acquisitions.

With a strong emphasis on capital deployment in existing lines, particularly in property reinsurance, the industry appears well-positioned to capitalize on current conditions.

As Reinsurance News understands, the strategic allocation of capital, whether through reinvestment in core areas or exploring new opportunities, will be crucial in sustaining this momentum and ensuring long-term success.

This website states: The content on this site is sourced from the internet. If there is any infringement, please contact us and we will handle it promptly.