Guidewire HazardHub provides risk data as wildfire season continues in the US

- August 25, 2025

- Posted by: Kassandra Jimenez-Sanchez

- Category: Insurance

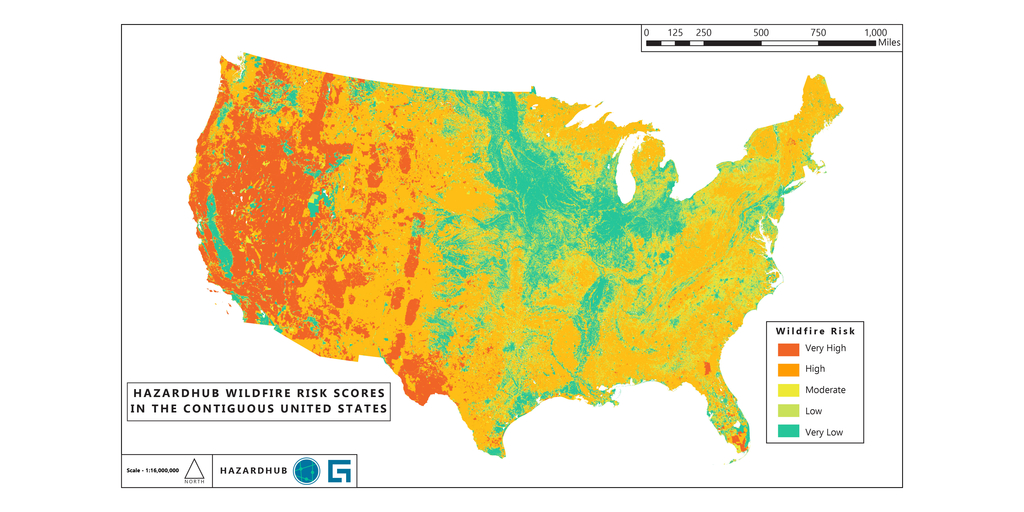

Guidewire, a provider of software solutions to the insurance industry, has announced the release of critical data and maps detailing wildfire risk in the United States, with this being available at the national, state, and local levels.

Wildfire season typically runs from spring to fall, but varies by region, typically impacting California and the western US. High temperatures, low humidity, and seasonal winds (such as the Santa Ana winds in California) further exacerbate wildfire risks.

Guidewire’s service leverages more than 1,000 data points and HazardHub risk scores for climate risks and extreme weather events.

The top states for wildfire risk are Nevada, Oregon, California, Idaho and Wyoming, according to Guidewire HazardHub Enhanced Wildfire Risk Score – which bases its results on the percentage of homes receiving an “F” rating for wildfire risk.

The HazardHub Enhanced Wildfire Score leverages granular geographical data, updated vegetation data, proximity to fire hydrants and fire stations, historical wildfire data, and environmental factors to provide a detailed and accurate assessment of wildfire risk.

Guidewire also released the top states by the number of homes at high risk of wildfire (rated as an “F” for wildfire risk). These are California, with 1.03 million homes; Oregon, with 100k homes; Colorado, with 64.5k homes; Washington, with 61.8k homes; and Arizona, with 61.7k homes.

According to analysis by Guidewire HazardHub, wildfire risk mitigation and home hardening efforts can reduce the risk of wildfire damage by as much as 70%.

Analysts also advised that by adopting minimal measures, consumers can reduce their risk of wildfire damage by approximately 20%. With more extensive measures, they can reduce their risk by as much as 70%.

Guidewire HazardHub was also able to provide wildfire risk data and maps for all 50 states and Canadian provinces including. Historical wildfire data consistently show that the most significant and destructive wildfires tend to occur in the western US.

California has experienced an average of 203 significant wildfires per year over the past decade (2014-2023). In 2023 alone, the state experienced 7,127 wildfires of any size, as reported by CalFire, and 329 significant wildfires, as accounted for by the Wildland Fire Interagency Geospatial Service (WFIGS).

Guidewire noted that WFIGS’ dataset focuses on significant wildfire events, excluding more minor or less impactful incidents. In the case of agencies like CalFire, they tend to include all reported wildfires within their jurisdiction, including both significant and smaller incidents.

Their data tends to be broader and includes more minor events, Guidewire added.

According to a Guidewire HazardHub analysis, in California, 98% of wildfire property damage occurs in the 10% of homes rated as “F” for wildfire risk. Homes in these “F” rated areas are approximately 40 times more likely to suffer damage compared to homes in other areas of the state.

Texas is another US state that experiences a high number of wildfires, one of the factors for this is its large size; these fires are often more rural, resulting in a lower concentration of risk and fewer homes exposed compared to other western states like California, Oregon, and Nevada, analysts noted.

In 2023, Texas experienced 7,530 wildfires of any size, as reported by the Texas A&M Forest Service, and 1,139 significant wildfires, as accounted for by the WFIGS.

Over the past decade (2014-2023), according to WFIGS, the state has experienced an average of 217.3 significant wildfires per year.

Tammy Nichols Schwartz, CPCU and Senior Director of Data and Analytics at Guidewire, commented: “Homeowners should aim to better understand their wildfire risk to inform their insurance coverage needs and implement effective mitigation strategies.

“Efforts such as creating a defensible space, and retrofitting homes with fire-resistant materials, windows, and vents can boost a home’s resilience by as much as 40% and help make insurance more affordable. Proactive mitigation is essential for safeguarding homes and contributing to a more resilient community and future.”

Insurers can access data and risk scores by the Enhanced Wildfire Score and HazardHub through Guidewire’s apps, including PolicyCenter and InsuranceNow, and via the HazardHub API.

This website states: The content on this site is sourced from the internet. If there is any infringement, please contact us and we will handle it promptly.