Global reinsurance capital hits $766bn in H1 2024: Gallagher Re

- August 6, 2025

- Posted by: Kane Wells

- Category: Insurance

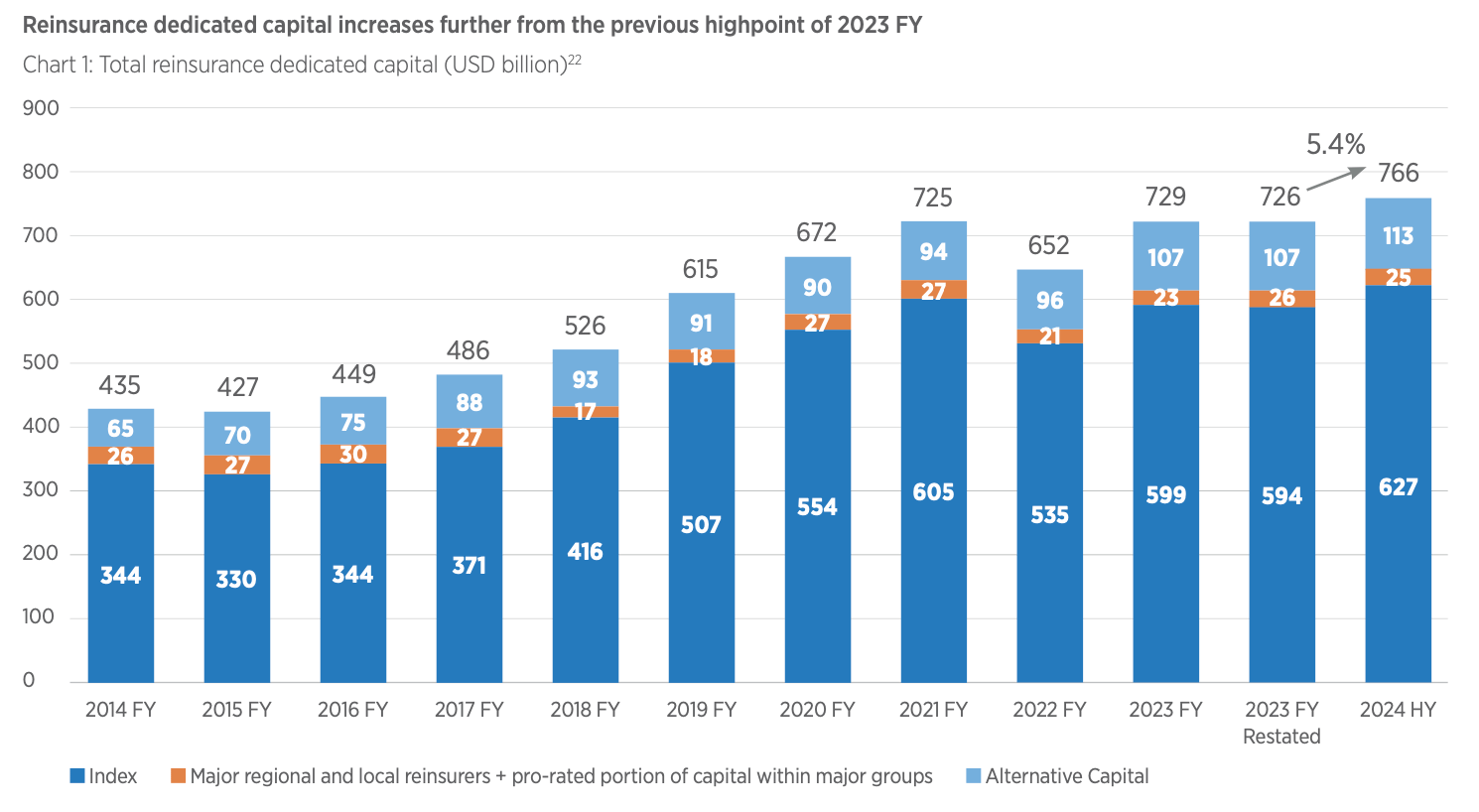

A new Gallagher Re report that tracks the capital and profitability of the global reinsurance industry has revealed that total capital continued to climb during H1 of 2024, reaching $766 billion, up 5.4% from 2023.

At the same time, the reinsurance broker’s report found that the underlying ROE of 15.5% in H1 2024 for SUBSET reinsurers (companies that make the relevant disclosure concerning natural catastrophe losses and prior year reserve releases) surpassed the cost of capital for the third consecutive year, pointing to better underlying underwriting margins and higher investment income.

Meanwhile, the reported ROE marginally increased to 19.6% in H1 2024 from 19.2% in H1 2023, settling at an “exceptional” level.

“As a result of the significant improvement in profitability over the past two years, the industry has fully recouped weaker profit years (2017-2020) and earned a margin on top of the cost of capital,” Gallagher Re explained.

Revenue growth among reinsurers also reportedly remained strong at 9% in H1 2024, largely driven by rate increases.

The reported combined ratio for SUBSET reinsurers dropped from 87% in H1 2023 to 84.5% in H1 2024, which is the lowest level since the launch of the firm’s Reinsurance Market Report in 2014.

“Despite reduced reserve releases and a higher expense ratio, this improvement is attributable to lower natural catastrophe losses and a better accident year loss ratio (excluding natural catastrophes),” Gallagher Re added.

Michael van Wegen, Head of Client & Market Insights International, Gallagher Re Global Strategic Advisory, commented, “Global reinsurers delivered another strong set of results in the first half of 2024.

“With ROEs continuing to sit comfortably above the cost of capital, reinsurers are in an extremely healthy position to absorb any potential volatility arising from, for example, natural catastrophes, financial markets, or interest rates.”

This website states: The content on this site is sourced from the internet. If there is any infringement, please contact us and we will handle it promptly.