Hurricane Helene may lead to significant losses for P&C re/insurers, says Moody’s

- July 14, 2025

- Posted by: Beth Musselwhite

- Category: Insurance

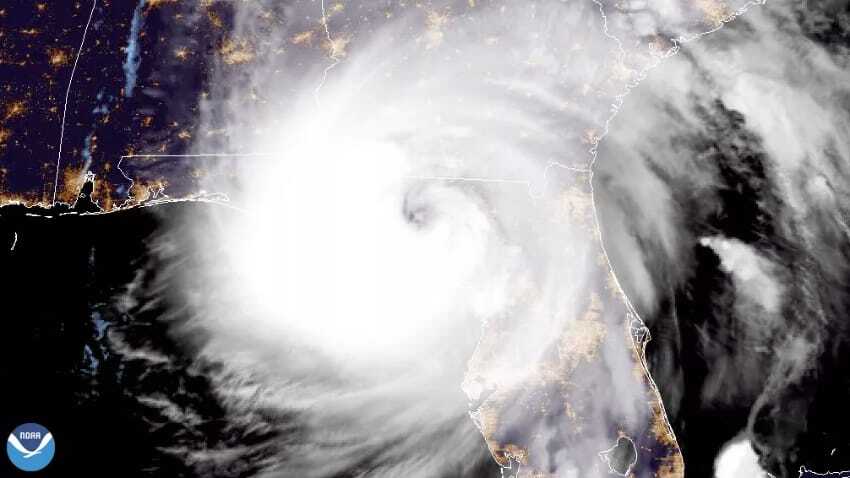

Hurricane Helene, which struck Florida on September 26, 2024, has caused significant damage and could lead to substantial losses for property and casualty (P&C) re/insurers, particularly in the homeowners and commercial property sectors, according to a recent Moody’s Ratings report.

Identified as a Category 4 storm, Hurricane Helene brought destructive winds, storm surge, and heavy rainfall, resulting in widespread property damage, mandatory evacuations, power outages, and tragic loss of life. After impacting Florida, the storm moved through neighbouring states, causing significant flooding.

The insurers most exposed are Florida-only carriers—those with at least 75% of their homeowners and commercial property premiums written in the state. The top 10 Florida-only insurers account for about 50% of the state’s homeowners insurance market, making them particularly vulnerable due to their concentrated geographic exposure.

Citizens Property Insurance Corporation serves as a Florida-only insurer of last resort. With $15 billion in readily available claims-paying resources, Moody’s believes Citizens is well-positioned to handle the losses from Hurricane Helene.

Moody’s analysts also note that large national homeowners insurers, such as State Farm and Allstate Corporation, face exposure from Hurricane Helene. However, they are generally well-prepared due to their careful monitoring of risks and geographic diversification across the U.S.

Furthermore, Moody’s expects the top 10 national homeowners insurers to absorb the hurricane-related losses effectively, thanks to their substantial resources, strong reinsurance protections, and large capital reserves.

Depending on the severity of the losses, primary insurers will likely share the financial burden with traditional reinsurers, particularly through quota share agreements.

The Florida Hurricane Catastrophe Fund offers up to $17 billion in reinsurance protection to insurers in Florida, with $6.9 billion in cash reserves available at the start of the season.

Homeowners’ policies, including those from Citizens, typically exclude flood damage coverage. Therefore, homeowners in flood-prone areas often obtain coverage through the government-backed National Flood Insurance Program, a division of the Federal Emergency Management Agency (FEMA). FEMA has previously assisted in repairing or replacing homes for those who are uninsured or underinsured after past hurricanes.

Commercial property coverage is provided by a mix of regional, national, and international insurers, generally protecting midsize to large businesses. Smaller businesses are often insured by companies that operate solely in Florida. In addition to property damage, commercial property claims usually include business interruption losses, which can be challenging to predict due to specific policy terms. Coverage for direct business interruption applies only if the damage is caused by a covered peril. Additionally, commercial property insurers may face flood-related losses if insured businesses opted for optional flood coverage.

Following the storm, Moody’s predicts total property damage could range from $15 billion to $26 billion. CoreLogic estimates that wind and storm surge losses for the insurance industry may reach up to $5 billion, while Steve Bowen at Gallagher Re expects private insurance market losses to be in the mid-to-high single-digit billions.

This website states: The content on this site is sourced from the internet. If there is any infringement, please contact us and we will handle it promptly.