Material reinsured hurricane Milton losses could change trajectory of pricing at Jan renewals: KBW

- July 7, 2025

- Posted by: Kane Wells

- Category: Insurance

Despite noting the considerable uncertainty around Hurricane Milton’s path and landfall location, analysts at KBW have suggested that possible reinsured losses from the event could drive property catastrophe reinsurance rates up at the January 1, 2025 renewals.

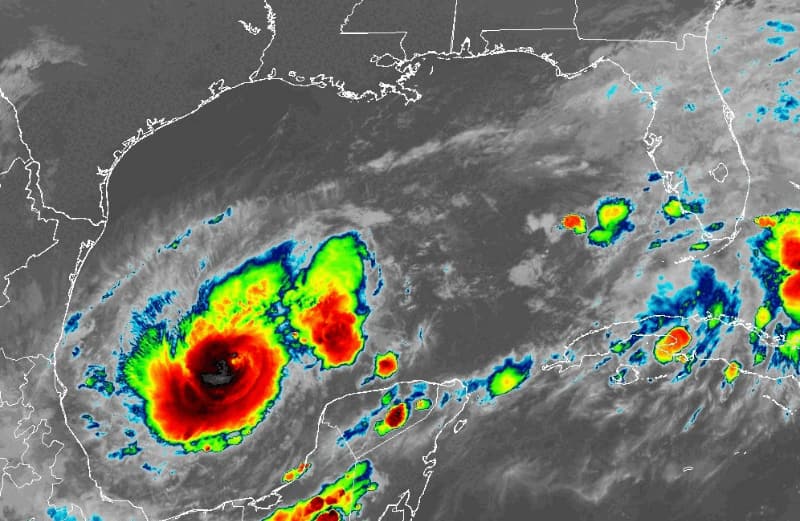

With the National Hurricane Center (NHC) currently projecting that Milton will make landfall on Wednesday as a major hurricane, a new report from KBW has observed that current track forecasts the event could cause “very significant” ($10 billion+) insured losses.

The analysts additionally highlighted that many Florida-focused property insurers buy relatively low attachment points, suggesting that reinsurers could collectively bear a higher percentage of Milton losses than of previous 2024 weather events.

As per KBW, this could consequently drive property catastrophe reinsurance rates up y/y during the January 1, 2025 renewals.

“Material reinsured Milton losses could change the trajectory of 2025 property reinsurance pricing. Our – obviously pre-Milton – Monte Carlo discussions anticipated mid-single-digit decreases, although the frequency of 2024 hurricane formation is already starting to convince us that mid-single-digit decreases are a worst-case scenario,” the analysts said.

They continued, “Significant primary insured losses could also highlight the weaknesses of Florida’s current reliance on numerous relatively small insurers plus Citizens, the state’s (ostensible) insurer of last resort.

“We see this situation – in which many of the nation’s largest property insurers maintain disproportionately low exposure to Florida – as ultimately unsustainable.

“If and when the state-focused insurers’ solvency is sufficiently pressured (most likely from a combination of retained net storm losses and expensive reinsurance), we expect Florida’s regulators to (eventually) allow the larger carriers to charge what the latter group deems adequate rates.

“Significant insured losses could also provide an acid test of the state’s December 2022 litigation reforms’ ultimate effectiveness, which remain a concern for at least some reinsurers.”

Earlier today, reinsurance brokers Guy Carpenter and Howden Re warned of potentially significant impacts from the storm as it heads towards the Florida coast.

“The ramifications of the upper end forecasts of Milton would result in a near worst case scenario for the west coast of Florida. There are no historical events that reasonably approximate the projected track of Milton. The five historical events that are closest to the Milton forecast are poor matches: the Cedar Key Hurricane of 1896, Gladys 1968, the October 1921 Tampa Bay Hurricane, Charley 2004, and Ian 2022. The 1921 Tampa Bay Hurricane would be the best fit of these 5,” Guy Carpenter said.

The latest update from the NHC reveals that Milton is now a major Cat 4 hurricane with maximum sustained winds of 150 mph.

The storm is expected to maintain this intensity for the next couple of days, suggesting a major landfall on the Florida coast.

This website states: The content on this site is sourced from the internet. If there is any infringement, please contact us and we will handle it promptly.