Helene private market insured losses to be up to $14bn, NFIP losses could surpass $2bn: Moody’s RMS

- July 29, 2025

- Posted by: Luke Gallin

- Category: Insurance

The impacts of hurricane Helene across Florida, Georgia, the Carolinas, and parts of the Mid-Atlantic are expected to drive insurance industry losses of between $8 billion and $14 billion, while losses to the National Flood Insurance Program (NFIP) could exceed $2 billion, according to Moody’s RMS Event Response.

This estimate from Moody’s RMS reflects wind losses in the aforementioned regions, storm surge losses in Florida, and impacts from precipitation-induced inland flooding in the affected regions, particularly North Carolina.

Moody’s RMS expects most of the private market losses to be driven by wind, with a higher contribution from Georgia than Florida, although storm surge in Florida and floods in North Carolina will also contribute notably to total private market-insured losses.

Broken down, Moody’s RMS estimates private market insured losses from wind (including coverage leakage) and storm surge (excluding NFIP) of between $6.7 billion and $12.3 billion, and inland insured flood losses (excluding NFIP) of $1.3 billion to $1.7 billion, leading to a total of between $8 billion and $14 billion, with a best estimate of $11 billion.

Estimated losses reflect property damage and business interruption to residential, commercial, industrial, and automobile lines of business, and also consider sources of post-event loss amplification (PLA) non-modeled losses from extended power outages, and infrastructure damage to roads, transmission, and distribution lines.

Additionally, the catastrophe risk modeller has said that losses to the NFIP could reach $2 billion or more, and these are expected to be driven by storm surge in Florida as flood insurance penetration in the flood-hit parts of North Carolina is minimal.

Moody’s RMS expects insured wind and NFIP losses to be driven by residential lines, while storm surge and inland flood losses to the private market will be driven by commercial, industrial, and automobile lines.

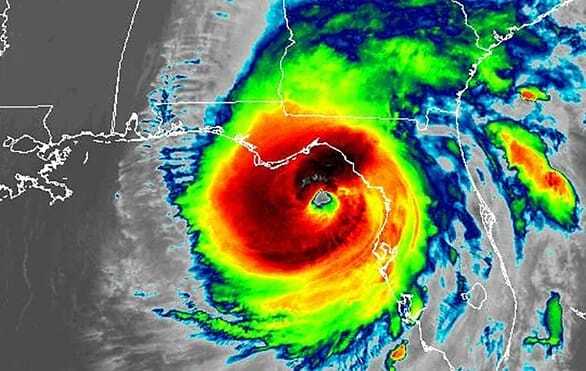

Hurricane Helene was the sixth named storm of the 2024 Atlantic hurricane season, and became the fourth of the season to make landfall in the U.S. on September 27th, when the storm struck west-southwest of Perry, Taylor County, Florida as a Category 4 with maximum sustained winds of 140 mph.

With many regions affected by Helene still trying to recover, hurricane Milton, currently a very powerful Category 4 storm, is on course to make landfall in Florida on Wednesday night local time, although there does remain some uncertainty as to the strength and location of the landfall. However, there will undoubtedly be overlap between the two storms, and this could make it challenging for claims adjusters to assign damages to the event that caused the most damage.

“Hurricane Helene is by far the most impactful event of the current 2024 hurricane season thus far, though this may quickly change with Major Hurricane Milton due to impact Florida in the coming days. With Helene, multiple states were affected with different degrees of damage from wind, storm surge, and excessive rainfall-induced flooding,” said Mohsen Rahnama, Chief Risk Modeling Officer, Moody’s.

“With a unique and complex event such as Helene, delivering a complete and well-informed view of expected losses across all major sources is paramount. In developing the wind footprint for this event, we benefited from access to critical observational data from areas that experienced the strongest winds, thanks to our exclusive partnership with Texas Tech’s StickNet program.

“Additionally, our broader observational data network that informs our Moody’s RMS HWind products allowed us to address remaining gaps in station coverage. Complimenting these quantitative data sources was a wealth of qualitative insights from aerial imagery analysis of building footprints and our field reconnaissance team that spent several days surveying the extent and severity of wind and water damage in Florida, Georgia, and South Carolina,” added Rahnama.

Firas Saleh, Director – U.S. Inland Flood Models, Moody’s said: “The worst impacts from this event are from inland flooding, where Helene completely devastated several towns in North Carolina, Tennessee, and surrounding states with historical levels of precipitation. Thousands of buildings were exposed to fast-moving waters over eight feet, and several to depths greater than 15 feet. We expect widespread damage and total constructive losses in these regions, with prolonged recovery after the catastrophic infrastructure damage.

“Unfortunately, flood insurance penetration is extremely low in the worst-affected region, meaning most of the damage will be uninsured, and economic property losses will far outweigh insured losses. We expect to see Helene accelerating flood insurance purchases to help close the significant flood protection gap in these regions.”

Raj Vojjala, Managing Director, Modeling and Analytics, Moody’s, commented: “From a wind perspective, the building stock in Florida continues to be resilient, thanks to improved code provisions and the requirement to ‘build back better’ following recent Hurricanes like Irma, Ian, Idalia, etc. However, in interior parts of Georgia and the Carolinas, building stock tends to be older with less stringent enforcement of wind design provisions. Many of these structures with aged roofs did not withstand damaging winds that extended far inland in Helene due to the fast forward speed of the storm.

“An unprecedented amount of treefall-related property damage, from high winds and saturated soils, further exacerbated wind losses in Georgia, making Helene potentially the worst hurricane loss in the state’s history. As such, even though the strongest winds were observed in Florida, we expect insured wind losses in this event to be driven by the interior states.”

Jeff Waters, Director – North Atlantic Hurricane Models, Moody’s, added: “The combined impacts of wind and water from this event are noteworthy. Helene underwent rapid growth and intensification in the days leading up to landfall, resulting in a large wind field that prompted storm surge forecasts of up to 20 feet along Florida’s Gulf coastline. While the observed surge was not as severe, exposure-rich areas like Tampa Bay and points northward experienced record water levels and surge losses during the event.

“NFIP take-up rates in Florida are the highest in the country, which should help absorb some of the losses in coastal counties. However, low coverage limits on NFIP policies mean a sizable portion of water damage could seep into the private market through standalone flood policies or via coverage leakage into wind-only policies.”

This website states: The content on this site is sourced from the internet. If there is any infringement, please contact us and we will handle it promptly.