Helene & Milton combined insured loss seen at up to $55bn by Moody’s RMS Event Response

- September 8, 2025

- Posted by: Luke Gallin

- Category: Insurance

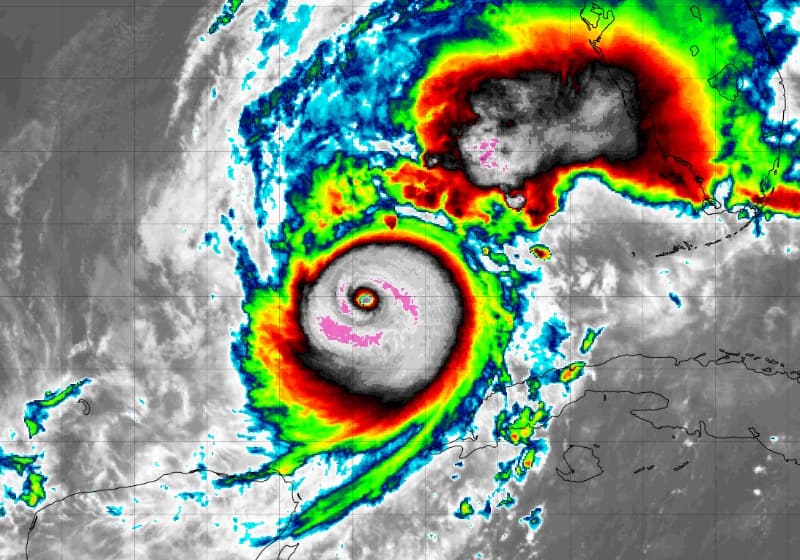

Catastrophe risk modeller Moody’s RMS Event Response expects private market insurance industry losses in the US from hurricanes Helene and Milton to fall between $35 billion and $55 billion, although warns of complexities and uncertainties surrounding loss estimates given the overlapping regions affected by the two storms.

Helene and Milton, the fourth and fifth hurricanes to make landfall in the US during the 2024 Atlantic hurricane season, impacted many of the same regions with damaging wind, storm surge, and inland flooding.

Last week, Moody’s RMS Event Response pegged insured losses from Helene at between $8 billion and $14 billion and estimated that losses to the National Flood Insurance Program (NFIP) could surpass $2 billion.

Today, the company has released a combined insured loss estimate range for losses associated with wind, storm surge, and precipitation-induced flooding from the two hurricanes, of between $35 billion and $55 billion, which suggests that insured losses from Milton will be much higher than losses related to Helene.

Moody’s RMS says that it will release its industry loss estimate for just Milton by the end of this week, and also its final loss estimate for Helene.

“This initial combined loss estimate is informed by Moody’s RMS Event Response’s rigorous approach to event insured loss estimation and includes a combination of observational data, detailed field reconnaissance so far spanning more than 2,000 miles, and aerial imagery analyses from both storms in the affected region,” said Mohsen Rahnama, Chief Risk Modeling Officer, Moody’s.

“Our reconnaissance teams are in Florida right now, and continue to survey the impacted areas. Estimating losses in these events is challenging and it is important to consider all associated complexities and uncertainties, especially in the overlapping regions affected by both hurricanes,” added Rahnama.

As noted by Rahnama, there’s a number of uncertainties that need to be considered, and each has the potential to both influence and prolong the claims settlement process for both events.

Some of the main uncertainties highlighted by the cat risk modeller include complex hazard patterns, coverage leakage across events, event attribution, annual hurricane deductibles, and damageable exposure.

This website states: The content on this site is sourced from the internet. If there is any infringement, please contact us and we will handle it promptly.