AM Best downgrades SCFBG’s ratings driven by Hurricane Helene losses

- July 4, 2025

- Posted by: Beth Musselwhite

- Category: Insurance

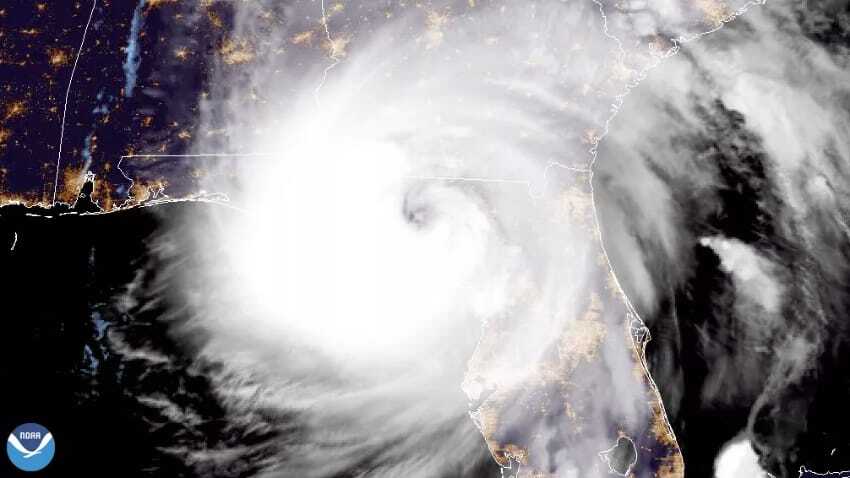

Global ratings agency AM Best has downgraded the Issuer Credit Ratings of South Carolina Farm Bureau Group (SCFBG) due to ongoing volatility in its operating results, primarily driven by weather-related events and inflationary pressures, particularly significant losses from Hurricane Helene.

SCFBG comprises South Carolina Farm Bureau Mutual Insurance Company and its reinsured affiliate, Palmetto Casualty Insurance Company. AM Best downgraded SCFBG’s Long-Term Issuer Credit Ratings (Long-Term ICRs) to “bbb” from “bbb+” while affirming its Financial Strength Rating (FSR) at B++.

The outlook for the FSR has been changed from stable to negative, and the Long-Term ICR outlook is also negative.

These ratings reflect SCFBG’s balance sheet strength, marginal operating performance, limited business profile, and appropriate enterprise risk management.

AM Best noted that SCFBG faced substantial losses from Hurricane Helene, which could rank among the largest events in the company’s history.

SCFBG is expected to retain its full $25 million catastrophe retention from this event, which will significantly impact its year-end 2024 bottom line results. Consequently, the group’s operating performance assessment has been downgraded from adequate to marginal.

The negative outlooks take into account the anticipated decline in SCFBG’s key balance sheet strength metrics in late 2024. Policyholders’ surplus is projected to decrease significantly due to ongoing underwriting volatility, adversely affecting the group’s overall level of risk-adjusted capitalisation, as measured by Best’s Capital Adequacy Ratio (BCAR).

Additionally, underwriting and reserve leverage are expected to increase, driven by rises in both premium and reserve bases alongside declines in policyholders’ surplus. If these metrics fall below AM Best’s expectations or weaken to a level that no longer supports a strong balance sheet strength assessment, further downgrades to the ratings may occur.

This website states: The content on this site is sourced from the internet. If there is any infringement, please contact us and we will handle it promptly.