Aon reports higher revenue, adds producers

- September 22, 2025

- Posted by: Web workers

- Category: Finance

Aon PLC reported double-digit growth in the second quarter, as its 2024 purchase of NFP Corp. boosted revenue, and an increase in “revenue-generating” staff is fueling more growth, the brokerage’s top executives said Friday.

Aon also acquired several smaller brokerages during the first half.

The company reported $4.16 billion in second-quarter revenue, a 10.5% increase compared with the same period last year, and up 6% on an organic basis, which excludes the effects of acquisitions and foreign currency fluctuations.

In its main insurance brokerage business, commercial risk solutions, Aon reported $2.18 billion in revenue, an 8.1% increase over the same period last year and up 6% on an organic basis.

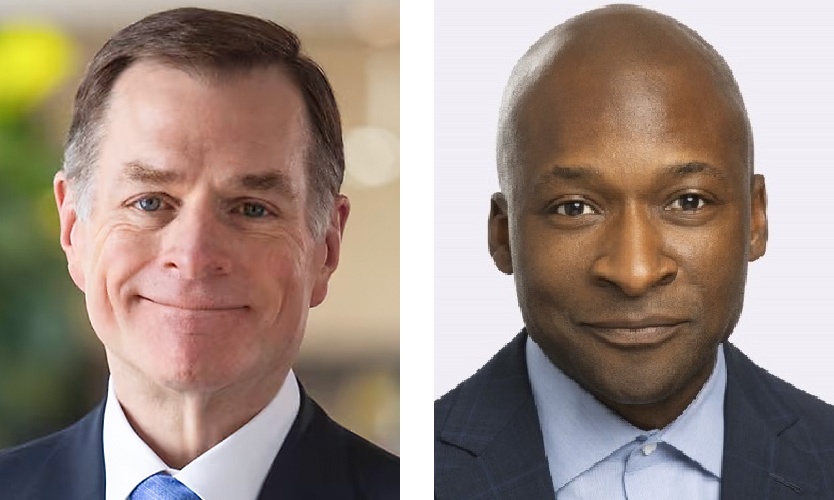

“Rate pressure in commercial risk was offset with limits and coverage increases across our book,” Chief Financial Officer Edmund Reese said on a call with analysts.

Its reinsurance division reported $688 million in revenue, up 8.3% over last year’s period and 6% organically.

Treaty reinsurance renewal rate decreases were offset by double-digit growth in insurance-linked securities business and international facultative placements, Mr. Reese said.

Health and benefits revenue increased 16.6% to $772 million, up 6% organically; and wealth management and investment advisory revenue increased 12.1% to $519 million, up 3% on an organic basis.

Aon completed its $13 billion purchase of NFP, which included a significant amount of benefits business, in April 2024.

Second-quarter net income increased 10.4% to $594 million.

A source of organic growth has been new producers, President and CEO Greg Case said.

“Our revenue-generating hires are up 6% through June 30,” he said.

New producers brought on in 2024 are expected to contribute 0.3% to 0.35% to organic revenue growth this year, Mr. Reese said. New hires contributed to double-digit revenue growth in Aon’s construction insurance broking business, he said.

Previously, Aon said it expanded its revenue-generating staff by 4% last year and expects to increase the number by 4% to 8% this year.

In the first half of 2025, Aon made eight acquisitions through NFP, which has a history of completing numerous deals to buy smaller brokers. The acquisitions represent $20 million in annualized earnings, with 80% of the earnings related to property/casualty, Mr. Reese said.