As industry losses from Milton rise, more will flow to reinsurers: Moody’s

- June 25, 2025

- Posted by: Kane Wells

- Category: Insurance

A new report from Moody’s has suggested that insured losses from Hurricane Milton will affect both primary insurers and the reinsurance sector, with the proportion of losses ceded to reinsurers increasing as losses increase.

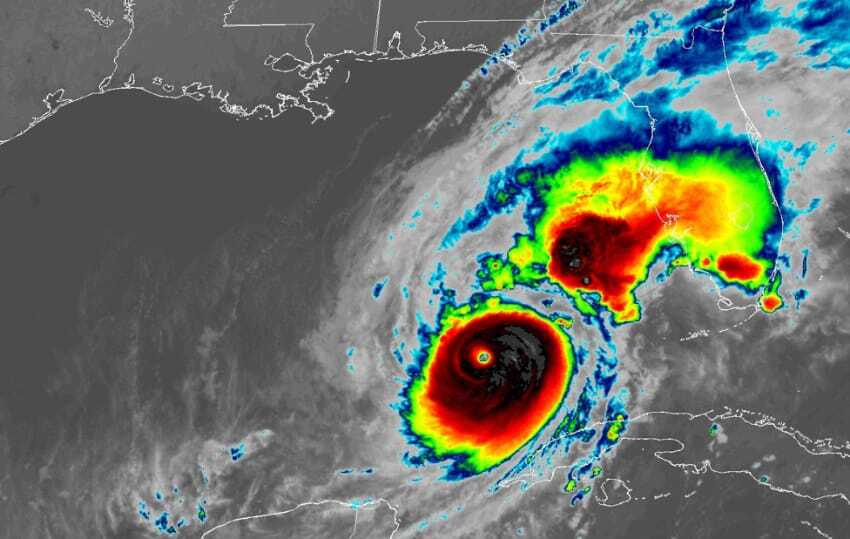

Milton made landfall on the 9th of October in Florida’s Sarasota County as a Category 3 hurricane, bringing damaging winds, tornadoes, life-threatening storm surge, and heavy rainfall.

According to Moody’s, the storm has the potential to generate significant losses for P&C re/insurers because it moved through densely populated areas, triggering various hurricane-related perils, including direct wind damage, roof leaks, damage from fallen trees, additional living expense claims, and business interruption.

Meanwhile, the flooding is expected to cause losses for personal and commercial auto insurers, with the claims handling process being complicated because Hurricane Milton occurred in close succession to Hurricane Helene.

Moody’s continued, “Although it will take weeks or months for insurers to have reliable estimates of insured losses, the storm’s large footprint and path across central Florida indicate that Hurricane Milton will be another costly US hurricane.

“We expect insured losses from the storm to affect both primary insurers and the reinsurance sector, with the proportion of losses ceded to reinsurers increasing as the magnitude of losses increases.”

The firm’s report went on, “Florida is a peak risk zone for property catastrophe reinsurance and nearly every reinsurer has some exposure to the state.

“Although reinsurers implemented significant pricing increases over the past several years and tightened terms and conditions on their reinsurance policies, including higher attachment points, we think a significant portion of insured losses from Hurricane Milton will be ceded to the reinsurance market.

“Most reinsurers have posted strong results through the first six months of the year, which will mitigate the financial impact of the losses.

“Nonetheless, if insured losses significantly work their way into the excess of loss layers, we expect to see elevated combined ratios for reinsurers with higher catastrophe risk appetites during the fourth quarter.”

Moody”s concluded, “During this year’s midyear reinsurance renewals, pricing for higher layer property catastrophe reinsurance declined 5%-10% as additional capacity entered the market.

“If aggregate insured losses from this year’s hurricane season significantly affect the reinsurance sector, reinsurance pricing during the 2025 reinsurance renewal periods could strengthen to attract sufficient capacity to meet demand.”

This website states: The content on this site is sourced from the internet. If there is any infringement, please contact us and we will handle it promptly.