Average U.S. commercial rates down in third quarter: Marsh

- May 17, 2025

- Posted by: Web workers

- Category: Finance

Average commercial insurance renewal rates in the U.S. returned to negative territory in the third quarter, led by property rates, Marsh said Thursday.

Casualty rates continued to increase, but those for property, financial and professional lines and cyber liability fell, as buyers benefited from a competitive insurance market, according to the broker’s quarterly pricing index.

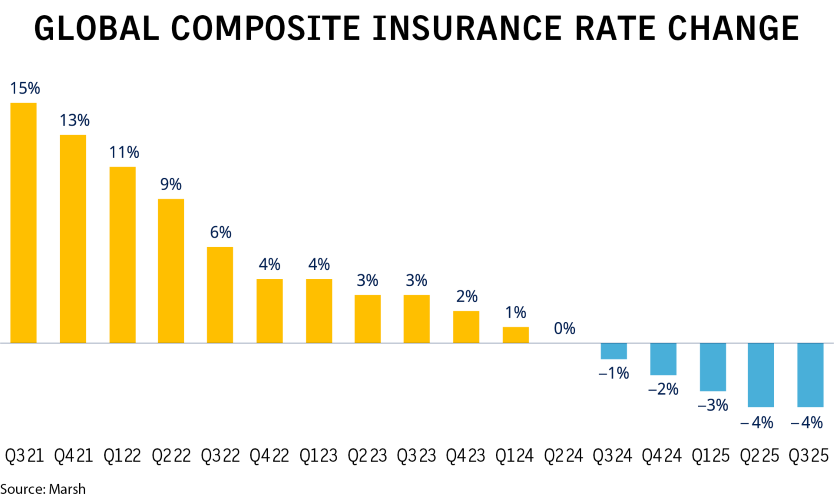

Globally, rates fell 4%, consistent with the second quarter, marking the fifth straight quarter of declines. Property rates fell 8%, financial and professional lines declined 5% and cyber rates were down 6%, while casualty rates increased 3%.

In the U.S., rates edged down 1%. They were flat in the second quarter.

Property rates declined 9%, unchanged from the second quarter, as some insurers offered more favorable policy terms to attract business amid increased competition, Marsh said.

Casualty rate increases in the U.S. decelerated to 8%, from 9% in the prior quarter. Excluding workers compensation, casualty rates increased by 11%.

Auto liability continues to face pressure from large jury verdicts and rising damage repair costs, Marsh said. General liability rates increased by 2%, with larger increases in the real estate, hospitality and public entity sectors, due to loss activity.

Umbrella and excess liability risk-adjusted rates rose 16%, down from 18% in the second quarter. Generally, rates increased 9%, compared with 14% in each of the prior two quarters, Marsh said. Some insurers cut back limits to $10 million in capacity per risk because of adverse U.S. litigation developments.

Financial and professional lines rates declined 2%, after remaining flat in the previous quarter. Cyber liability rates fell 3%, the 10th consecutive quarterly reduction, Marsh said.