Back-to-back hurricanes call for careful loss documentation

- October 31, 2025

- Posted by: Web workers

- Category: Finance

Commercial property owners filing two claims from back-to-back hurricanes should review what their policies cover, how deductibles and limits might apply, and deadlines by which hurricane damage must be reported to insurers.

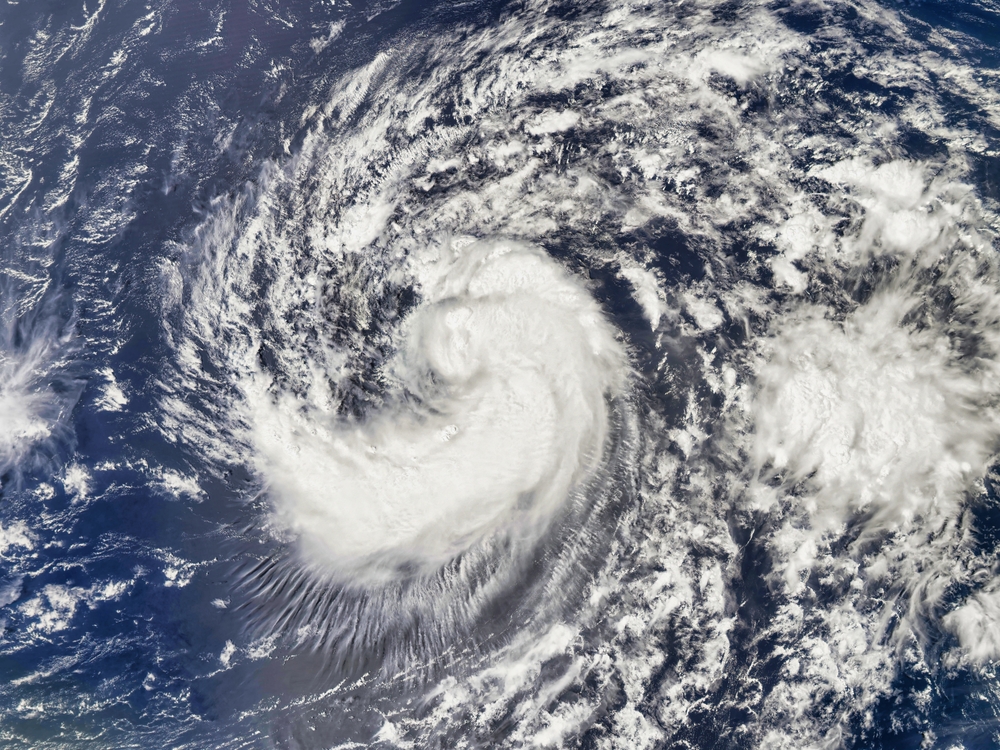

Back-to-back hurricanes are not unusual, but Hurricanes Helene and Milton, which struck the Gulf Coast of Florida just two weeks apart, highlight the importance of mitigating property damage and documenting losses for each storm, experts say.

Policyholders should meet with their agents to fully understand the coverage, deductibles and limits provided by their policies, said Meredith Brogan, Atlanta-based president, Network Solutions, at Crawford & Co., who oversees the claims management company’s catastrophe division.

“In back-to-back hurricanes, coverage is extremely important. Many people don’t realize that they are not covered for flood unless they have a separate policy,” Ms. Brogan said.

Hurricane Helene was largely a flood event, whereas there were more wind claims from Hurricane Milton, she said.

Many policies include seasonal hurricane deductibles, which means that a single deductible would apply for the two events, Ms. Brogan said. “That could be helpful, but it’s all driven by your policy. If your policy doesn’t include it, then obviously you could have two separate deductibles altogether,” she said.

How to allocate property damage between two storms is a key issue in connection with back-to-back hurricanes, said Dennis Artese, a shareholder in the New York office of Anderson Kill P.C.

“Oftentimes, there’s just not enough time between the two events to fully document the first loss, so it may not be crystal clear exactly how much additional damage was caused by the second event,” Mr. Artese said.

As long as policy limits are sufficient to cover all the damage, it may not matter, but “where per occurrence limits are insufficient, the policyholder is wise to try to trigger another occurrence with additional damage to then trigger another set of per occurrence limits,” he said.

In cases where there is a substantial named storm deductible, insurers may seek to allocate the additional damage to a second storm and allege that the additional damage falls within the second storm’s deductible, Mr. Artese said.

Policyholders should keep the claims separate as much as they can, said Michael S. Levine, Washington-based partner at Hunton Andrews Kurth LLP.

“Perhaps there was flood damage to the lower portion of a property, and then roof damage to the upper portion from wind. Those scopes of damage would be fairly discrete, but when you start talking about roof damage and then more roof damage or flood damage and additional flood damage, then it becomes tougher,” Mr. Levine said.

Policyholders should not immediately agree with an insurer’s assessment that subsequent damage is somehow related to earlier damage, he said. “You can’t just eyeball it. You really have to get down to it,” he said.

Property owners and chief financial officers should ensure they have a working knowledge of all policy limits and sublimits, said Chip Merlin, Tampa, Florida-based founder and president of Merlin Law Group.

Business interruption and extra expense coverage, including loss of income and increased temporary expenses businesses incur while repairs are being made, can often get overlooked because the focus is on property damage when a hurricane hits, Mr. Merlin said.

Hurricane Milton, for example, caused significant damage to the roof of Tropicana Field in St. Petersburg, Florida, the stadium that is home to Major League Baseball’s Tampa Bay Rays.

“People don’t fully understand what extra expense coverage is, but sometimes it’s the most valuable coverage to a business that just had significant damage when their current place of operation is not available,” he said.