Broker M&A deals steady after slowdown

- April 14, 2024

- Posted by: Web workers

- Category: Finance

Merger and acquisition activity in the first half of 2023 among North America’s insurance agents and brokers dipped below 2021 and 2022 levels but was nonetheless ahead of the pace set in earlier years.

While rising interest rates and a somewhat restrictive lending environment have led some buyers to stand on the sidelines over the past 12 months, there are plenty of others that are very active, including a large number of firms making their first deal.

The total number of U.S. and Canadian transactions involving property/casualty agents and brokers, benefits brokers, managing general agents, third-party administrators and related businesses during the first half of this year fell 24% to 359 from 474 during the first half of 2022 but was equal to the previous five-year average.

On a quarterly basis, there were 177 transactions during the second quarter, more than a third lower than the 275 reported in the same period in 2022. On a trailing 12-month basis, the deal count was 913, 11% lower than the 1,028 reported in all of 2022 and 24% below the 1,203 reported for the year-earlier period.

Buyers’ appetite beyond the traditional insurance distribution targets has expanded significantly over the past few years. The broad buy-side universe has a deeper appetite, with a marked increase in seller types that includes more life insurance and financial services companies, including wealth management, human resources consulting, actuarial services and other ancillary business directly or tangentially related to insurance distribution. There have been 36 such acquisitions so far in 2023, which is a third lower than the 54 reported in the same period last year.

<div align=”center”><a rel=”gallery” class=”fancybox” href=”https://www.businessinsurance.com/assets/pdf/BI_0723_10A.png”><span class=”rsrch_img” style=”background:white !important; width: 480″>

<img src=”https://www.businessinsurance.com/assets/pdf/BI_0723_10A.png” width=”480″></span></a></div>

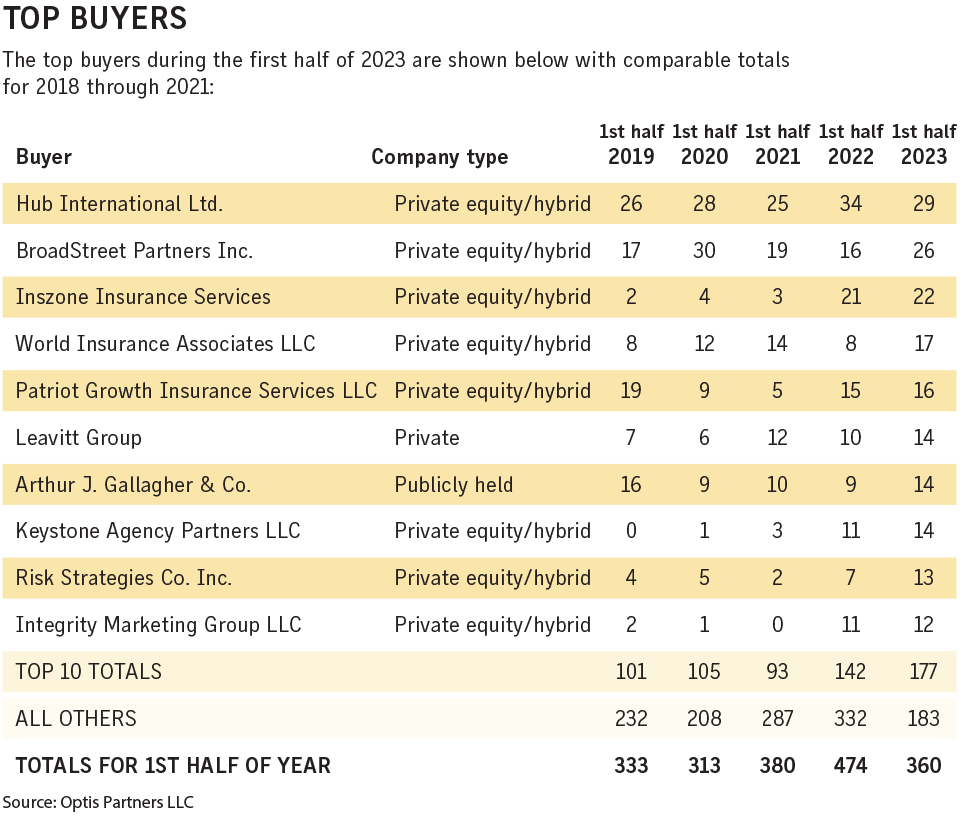

Private-equity-backed firms continue to dominate the deal-making landscape, something that we don’t see changing for many years ahead. What has changed to some degree is which firms appear to be most active: World Insurance Associates LLC, Risk Strategies Co. and NFP Corp. appear on the Top 10 list of most active buyers for the first time. Also appearing for the first time is Leavitt Group, which is the only private firm to appear on this list.

Hub International Ltd., BroadStreet Partners Inc. and Inszone Insurance Services LLC were out front in the first half of 2023 reporting 29, 26 and 22 deals, respectively. While Hub’s pace was off 15% over the same period in 2022, BroadStreet increased its activity by more than 60%, and Inszone was up 5%. Each of the remaining 10 most active buyers picked up their pace over the same period in 2022 by 10% or more. World Insurance Associates led all by more than doubling its deal count.

<div align=”center”><a rel=”gallery” class=”fancybox” href=”https://www.businessinsurance.com/assets/pdf/BI_0723_10B.png”><span class=”rsrch_img” style=”background:white !important; width: 480″>

<img src=”https://www.businessinsurance.com/assets/pdf/BI_0723_10B.png” width=”480″></span></a></div>

In total, the 10 most active buyers booked nearly half of the announced transactions so far in 2023, and there were 74 buyers that booked the rest. In total, there were 39 buyers that did more than one transaction in the first half of 2023, and there were 33 that reported making their first acquisition.

Historically active buyers whose transaction count dropped below their five-year average included Acrisure LLC, which is focusing more on integrating its purchased business than making new deals. Also in this category are PCF Insurance Services and Baldwin Risk Partners LLC, both of which have largely suspended dealmaking for the time being.

So far in 2023, there has been only one large transaction. In May, BroadStreet Partners acquired Canadian broker Westland Insurance Group Ltd. Westland had been a very active acquirer, having completed 47 transactions since 2018.

Among the very large brokers, there were two that reported significant minority investments by private equity. Truist Insurance Holdings Inc. sold a 20% stake in its brokerage business to Stone Point Capital LLC, and Hub International announced it will sell a substantial minority interest to Leonard Green & Partners LP, with a closing scheduled for the third quarter of this year.

Despite the fact that some historically very active buyers have slowed or stopped deal activity, the total number of buyers remains robust. This includes very large privately held firms that are becoming more acquisitive. There is plenty of evidence to suggest that we are still in a seller’s market.

We anticipate deal activity to remain steady throughout the remainder of 2023. The number of deals closed may be 10%-20% off the peak in 2021, but it should still be well above the volume from earlier years.

Steven E. Germundson, Timothy J. Cunningham and Daniel P. Menzer are principals at Optis Partners LLC, an investment banking and financial consulting firm in Chicago and Minneapolis that serves the insurance distribution sector. Mr. Germundson can be reached at [email protected] or 612-718-0598; Mr. Cunningham can be reached at [email protected] or 312-235-0081; Mr. Menzer can be reached at [email protected] or 630-520-0490.