Broker M&A up 11.4% in Q1: MarshBerry

- July 20, 2025

- Posted by: Web workers

- Category: Finance

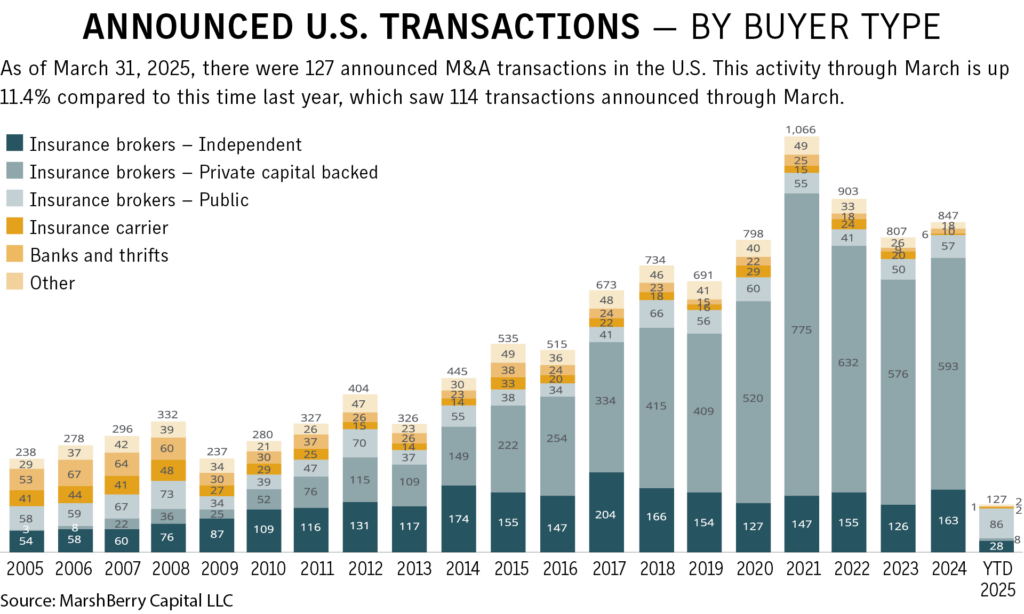

There were 127 announced broker merger and acquisition transactions in the U.S. through March 31, 2025, up 11.4% compared with the 114 transactions announced through this time last year, according to a report Wednesday from consultants MarshBerry Inc.

Private capital-backed buyers accounted for 86 of the 127 transactions, or 68%, in 2025, while independent agencies were buyers in 28 deals, or 22% of the market.

The private capital-backed segment of the market has grown steadily since 2019, when it accounted for 59.3% of transactions.

Just over a quarter of all deals, or 26%, came from the top three buyers – BroadStreet Partners Inc., with 16 deals, or 12.6% of the total; King Insurance Partners, with nine deals, 7.1%; and Keystone Agency Partners LLC, with eight deals, 6.3%.

More than half of all transactions, 71 deals or 55.9%, came from the top 10 buyers.

First-quarter 2025 valuations remained roughly flat at 15.17 times earnings before interest, taxes, depreciation and amortization compared with 15.06 in fourth-quarter 2024.

The impact of macro-economic factors including tariffs remains uncertain as recessionary fears grow.

While J.P. Morgan raised its risk of a recession this year to 60%, up from 40% earlier in the week and up from 30% at the start of the year, and Goldman Sachs raised its 12-month recession probability up to 45% after raising it to 20% a week earlier, the report noted that “the insurance industry continues to maintain optimism for a strong year,” MarshBerry said.

The overall stock performance of six public brokers as of April 4 as measured by MarshBerry’s Broker Composite Index is up 8.0%.