Broker M&As continue, but pace slows

- October 10, 2025

- Posted by: Web workers

- Category: Workers Comp

The insurance agent and broker industry in the 21st century has been marked by consolidation and elevated levels of investor interest. There have been nearly 9,300 mergers and acquisitions in the sector since 2008. That is an average of 550 deals per year among nearly 1,300 unique buyers. Despite this level of consolidation, there remains approximately 35,000 independent agencies.

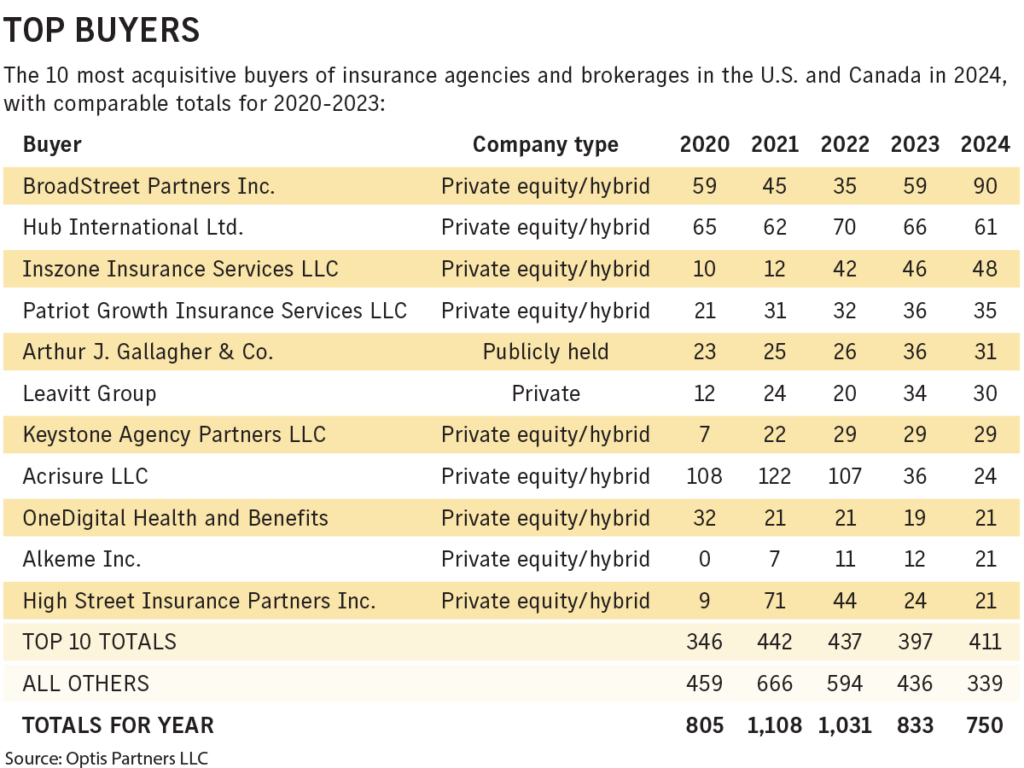

This provides a sense of the industry’s scale and context to recent M&A trends. Deal activity in both 2023 and 2024 was lower than in the peak of 2021-2022, and yet this slowdown should be viewed in the context that the level was well above the 2021 and 2022 pre-peak levels. Transactions totaled 750 in 2024, compared with 833 in 2023 and 1,031 in 2022, marking declines of 10% and 27%, respectively.

These totals include U.S. and Canadian property/casualty and employee benefits brokerages, third-party administrators, managing general agents, life insurance, investment or financial management, consulting, and other business connected to insurance distribution. It does not, however, include all M&A activity, as many private transactions are not disclosed publicly.

The last eight quarters yielded a rather steady level of deal volume that ran from 164 to 238 per quarter. Once again, there was no fourth-quarter race to the finish line in 2024, and, in fact, there was a slight decline over the third-quarter total. This was the opposite of the fourth quarters of 2020-2022.

Looking at all reported transactions, the 410 second-half transactions in 2024 were 21% higher than the first half of 2024, but only 8% below the second half of 2023 and 20% below the previous five-year second half average. For the year, 2024 was 15% below the previous five-year average.

Who are the buyers? They are segmented into the following categories:

- PE-hybrid: Private-equity-backed and private companies with significant outside acquisition financial support

- Publicly traded

- Privately owned

- Bank-owned

- Others (TPAs, life, wealth advisers, etc.)

Within these groupings, there were 794 unique buyers during the last 10 years, 94 of which were sponsored by private equity. It is relevant to note these private-equity-supported buyers have consistently driven most of the M&A activity since the turn of the century. Indeed, this group accounted for more than 72% of the deals in 2024 and 68% over the last 10 years. By way of contrast, of the 700 other buyers there were 522 privately owned, consistently representing 19% of reported deals. Nonetheless, the trend in the industry is a reduction in total unique buyers since 2017.

While there have been a large number of buyers in the last 10 years, eight companies accounted for 42% of all acquisitions in the period. At their peak, these eight companies accounted for 48% of the deal volume between 2018 and 2020. In 2024, they accounted for 36%.

The PE/hybrid group occupies eight of the top 10 spots in the table above and accounted for 541 of the year’s 750 transactions, or 72%. Exceptions to the rule were Arthur J. Gallagher & Co. and Leavitt Group, each a consistent acquirer. Including their deals in the Top 10 above yields 411 of the 750 transactions for the year, or 55% of the total.

Broadstreet Partners sits at the top with 90 deals in 2024 (up by 31 from 2023), followed by Hub International at 61 (down five) and Inszone Insurance Services at 48 (up two). All other companies reported fewer than 40 transactions. Among the most active acquirers, Broadstreet and Alkeme are the only two that are consistently increasing their pace of deal making.

Some other statistics from the 2024 activity:

- 40 different PE-hybrid buyers acquired 541 agencies, an average of 13 transactions each; four PE-hybrid buyers made their first acquisition during the year.

- There were 44 privately owned companies that acquired a total of 128 agencies, compared with 66 that bought 187 agencies in 2023, averaging just shy of three deals each year.

- 43 companies closed only one transaction, while 34 acquired five or more

- There were 28 first-time buyers, compared with 42 in 2023.

Property/casualty brokers continued to dominate the sell-side M&A landscape, with 477 of the 750 transactions, or 64% of the total. Employee benefits brokers were next, with 102 transactions representing 14% of the total. The combined total of property/casualty and employee benefits retail sellers was 660, or 88% of all deals done in 2024.

What stands out in the sell-side story in 2024 were three giant deals: Aon PLC’s purchase of NFP Corp., Marsh McLennan Agency’s purchase of McGriff Insurance Services, and Arthur J. Gallagher’s announced acquisition of AssuredPartners. (The AssuredPartners deal, set to close in the current quarter, is not included in the table).

Conversations with several private-equity-backed buyers indicate plans for recapitalization and, for some, a public offering in 2025 and early 2026.

Looking ahead, we expect consolidation to continue this year. The companies that thrive in the future will require sufficient scale to recruit talent, take advantage of artificial intelligence and other technologies, and garner volume to hold negotiating leverage in the marketplace. The need for scale comes at a time when continuing demand from investors to put capital to work meets up with the need to sell by a large number of agency owners. That should drive deal activity at its current pace for the foreseeable future.

The industry will also experience a level of regeneration as new agencies are formed by entrepreneurial producers and production teams that spin out of the large organizations to start their own platform. A subset of this group comprises those that move their businesses to other established companies via producer lift outs.

Lastly, there will likely be some consolidation through the merger of smaller companies in an attempt to capture scale in order to compete in the marketplace, among other reasons.

Throughout all economic, social and political conditions, the insurance distribution industry continues to adapt, thrive and prosper. With that in mind, we can expect an active M&A climate for many years.

Steve Germundson, Timothy Cunningham and Daniel Menzer are principals at Optis Partners LLC, a Chicago-based investment banking and financial consulting firm that serves the insurance distribution sector. Mr. Germundson can be reached at [email protected] or 612-718-0598; Mr. Cunningham can be reached at [email protected] or 312-235-0081; and Mr. Menzer can be reached at [email protected] or 630-520-0490.