Brokerage M&As slow in first quarter: Optis

- October 19, 2025

- Posted by: Web workers

- Category: Workers Comp

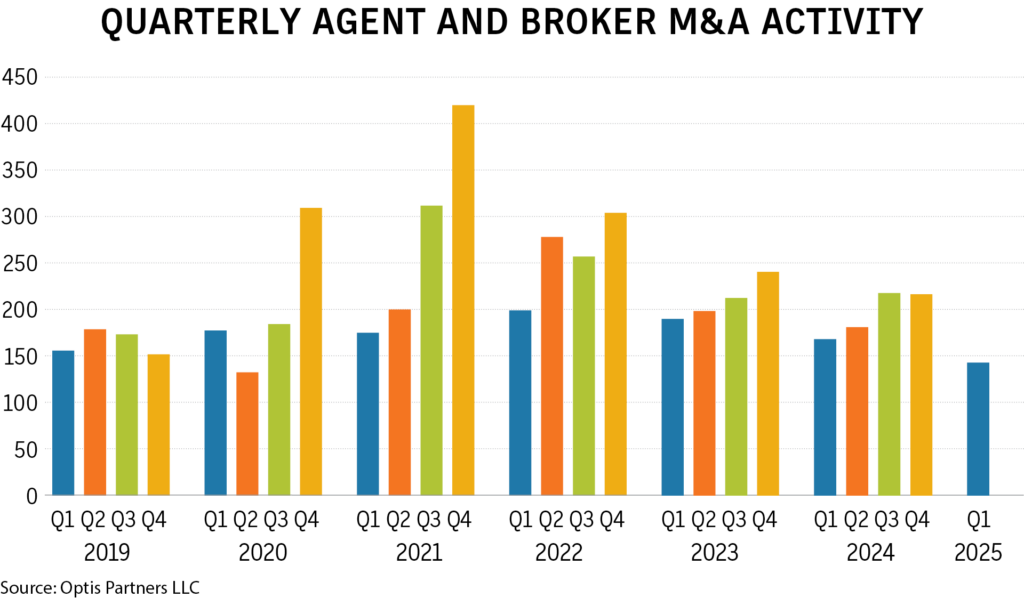

The pace of mergers and acquisitions among insurance agents and brokers fell in the first quarter to the lowest level since the COVID-19 pandemic, according to a report by Optis Partners LLC released Thursday.

There were 141 deals announced in the first quarter of 2025, a 15% decline from the same period last year. It also marked the ninth consecutive quarter where deal volume was below the long-term trend line, the Chicago-based investment banking and financial consulting firm said in the report.

Among the 46 buyers announcing deals, 25 were private-equity firms and 17 were privately held, the report said. Private-equity and private companies with significant outside financial support accounted for 73% of the deals.

BroadStreet Partners Inc. was the most active buyer with 18 deals in the quarter, followed by World Insurance Associates LLC with 10 and Hub International Ltd. with nine.

Among publicly traded brokerages, Aon PLC and Arthur J. Gallagher & Co. announced six deals each.

The quarter’s largest deal was Gallagher’s purchase of Woodruff Sawyer & Co., which was announced in March and completed in April.