Cat bond issuance most active in ILS market history: Aon

- November 1, 2025

- Posted by: Web workers

- Category: Finance

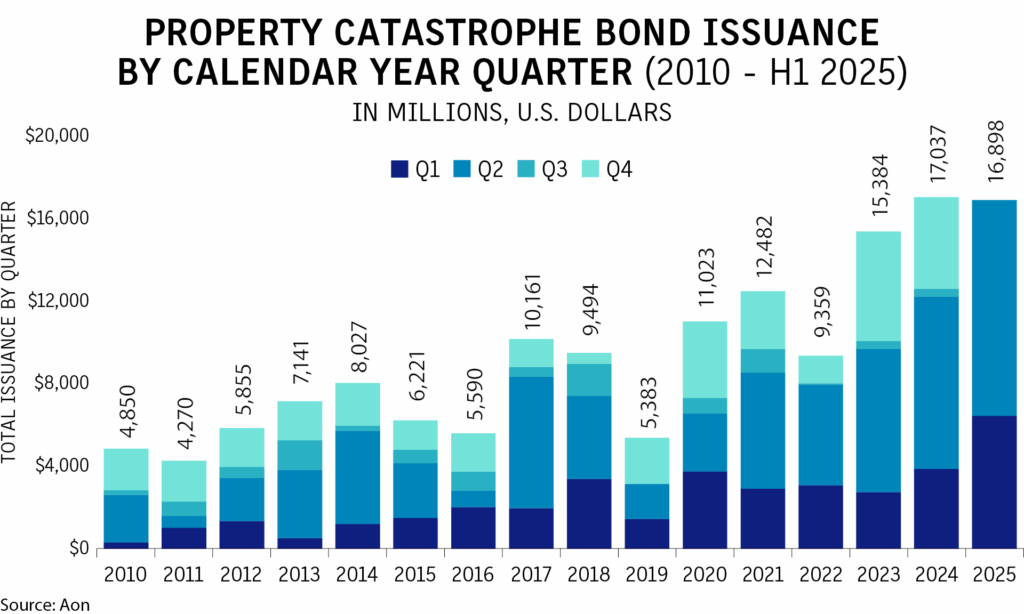

Catastrophe bond issuance for the 12 months ended June 30 totaled over $21.7 billion, making it the most active 12-month period in the history of the ILS market with a 21% increase from the year-ago period, according to a report Thursday from Aon.

First-half 2025 catastrophe bond issuance reached nearly $17 billion across 56 transactions, almost matching the total notional amount issued for the full year of 2024 in just six months.

Average deal sizes have also increased, with first-half 2025 transactions averaging $302 million, a 12% increase from second-half 2024.

The vast majority of deals, 93% of new issuances, covered North America perils. “Florida-focused issuances” increased to a record $5 billion, a 46% increase over the prior-year period.

Meanwhile, sidecar capacity increased to an estimated $17 billion across both property and casualty lines, the Aon report said.

The increase in activity has been driven by favorable market conditions, with investors generating double-digit returns across consecutive years; maturities of nonloss impacted catastrophe bonds together with new capital inflows; and the absence of severe loss activity.

Even losses from Hurricanes Beryl, Helene and Milton, alongside record-setting California wildfires, were manageable for investors, Aon said.

Also, cedents are increasingly seeking coverage beyond what is available in the traditional reinsurance market, according to Richard Pennay, CEO of Aon Securities.