Commercial auto liability premiums jump 19% in Q1: S&P

- October 21, 2024

- Posted by: Web workers

- Category: Finance

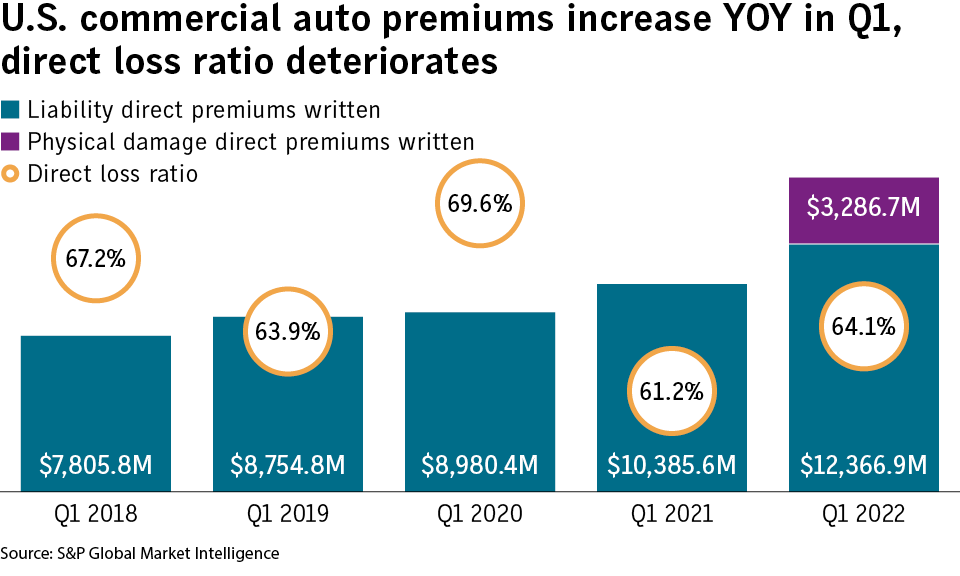

First-quarter commercial auto liability direct premiums written rose 19.1% year over year to $12.37 billion in 2022 and have risen steadily over the past five years, according to a report Thursday from S&P Global Inc.

Liability direct premiums written in the first quarter have jumped 58.4% from first quarter 2018’s $7.81 billion for the business line, data from the report showed.

Including commercial auto physical damage lines, the total U.S. commercial auto direct premiums written for the first quarter totaled $15.65 billion.

The Progressive Corp. by far has the largest market share of the U.S. commercial auto market with $2.84 billion of first-quarter direct premiums written, according to S&P’s data. Progressive incurred a direct loss ratio of 68.8%.

Premium growth was bolstered by more vehicles per policy and a shift in the business mix toward higher premium coverage, Progressive reported in a recent filing with the U.S. Securities and Exchange Commission, S&P said.

The Travelers Cos. Inc. is a distant second with first-quarter direct premiums written of $828.3 million, followed by Farmers Insurance Group of Cos. at $722.9 million. Travelers and Farmers recorded loss ratios of 60.0% and 69.5%, respectively.

Most of the largest U.S. commercial auto insurers showed loss ratios below 70%, S&P said in its report.