CoreLogic pegs insured wind and flood losses from hurricane Milton at up to $28bn

- November 1, 2025

- Posted by: Saumya Jain

- Category: Insurance

According to initial data analysis by catastrophe risk modeller, CoreLogic, industry-wide insured wind and flood losses from hurricane Milton are estimated at between $17 billion and $28 billion.

The total damage from Milton, including losses to uninsured property, will be between $21 billion and $34 billion, and CoreLogic’s assessment reveals that most of the privately insured losses, $13 billion to $22 billion, will be from wind.

The catastrophe risk modeller expects that combined flood losses will account for $4 billion to $6 billion of the total insured loss, which includes losses covered by the private flood insurance markets and the National Flood Insurance Program (NFIP).

A breakdown shows that coastal flood losses are expected to be highest in Sarasota and areas to the south such as Naples and Ft. Meyers. Meanwhile, precipitation-induced inland flood losses are expected primarily in the Tampa Bay area.

These estimated losses for Milton reflect property damage and business interruption to residential, commercial, and industrial property damage from both storm surge and precipitation-induced inland flooding. CoreLogic’s loss estimate does not include damage to offshore property or damage from the associated tornado outbreak.

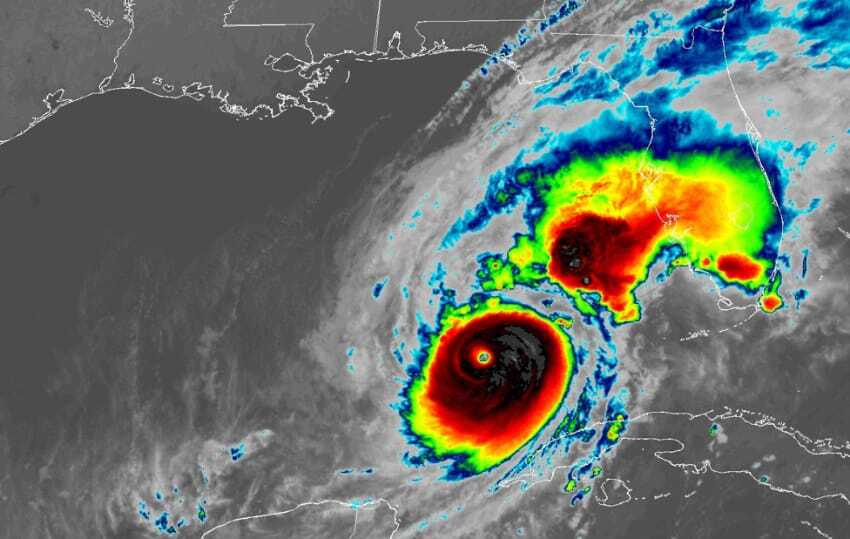

Dr. Daniel Betten, Director of Forensic Meteorology at CoreLogic, commented, “Hurricane Milton was an unusual storm, causing unexpected wind and flood conditions across the state of Florida.

“As Hurricane Milton neared landfall, it interacted with the jet stream over the southeastern U.S. causing the winds on the northern and northwestern sides of the hurricane – generally known to be weaker – to be atypically strong. To add to the complexity, weather gauges in coastal Florida also measured hurricane force winds over Sarasota south of where Milton made landfall, essentially creating two distinct lanes of damaging, hurricane-force winds.”

Tom Larsen, Associate Vice President Hazard & Risk Management at CoreLogic, who is currently on the ground in Florida analyzing damage, added, “Given the large concentration of property in the Tampa Bay area, including older residential and high-value commercial structures, large insured losses were possible.

“However, what we are seeing is less than expected wind damage and very little storm surge flood damage, especially in the population centers of the Tampa Bay area.”

The catastrophe modeller stated, “Although there was severe local flooding, it will not contribute as significantly as wind to the insured loss total. The most severe storm surge flooding occurred at Siesta Key, Fla. right at the point of landfall.

“Flood depths greater than six feet above the ground surface were reported as far south as Ft. Meyers. Precipitation gauges recorded a maximum rainfall depth in the Tampa Bay area. Widespread rainfall depths between 10 and 15 inches were measured with local maximum of approximately 19 inches in a 24-hour period in St. Petersburg.”

Two major hurricanes making landfall in Florida in under two weeks will make for a challenging recovery for the residents of Florida and the insurers operating there.

Even though Helene made landfall miles from Tampa Bay in the Big Bend region of the Florida coastline, there is bound to be some overlap between the tropical storm force wind fields, storm surge, and inland flooding leading to difficult loss attribution between the two storms.

“The overlap of severe storm surge damage in the Tampa Bay area during Helene and possible wind damage during Milton creates a scenario where leakage into wind-only policies is possible,” concluded CoreLogic.

Analysts at Moody’s RMS Event Response yesterday estimated total private insurance industry losses from Milton to fall between $22 billion and $36 billion. Verisk pegged the insured industry losses to onshore property from Milton at a range of $30 billion to $50 billion.

Meanwhile, it seems that Milton could lead to a flattening of pricing in the property catastrophe market at the upcoming January 1 2025 reinsurance renewals, according to Dean Klisura, Chief Executive Officer (CEO) of Guy Carpenter.

This website states: The content on this site is sourced from the internet. If there is any infringement, please contact us and we will handle it promptly.