Expect private insurance market losses from Helene in the mid-to-high single-digit billions: Bowen, Gallagher Re

- July 11, 2025

- Posted by: Luke Gallin

- Category: Insurance

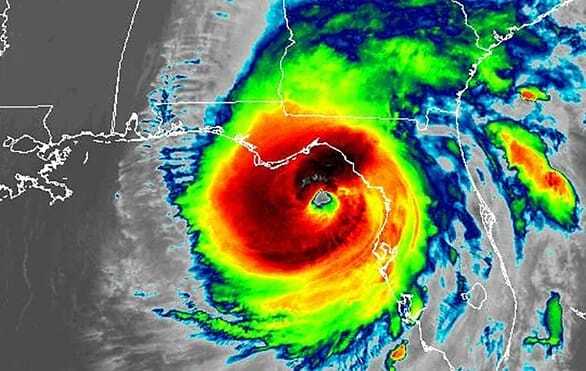

Following hurricane Helene’s landfall last week as a Cat 4 storm on the Big Bend area of Florida, Steve Bowen, Chief Science Officer at reinsurance broker Gallagher Re, has said that economic losses will be well above $10 billion and that the impact to the private insurance market is expected to fall in the mid-to-high single-digit billion dollar range.

This insured loss estimate is slightly higher than Gallagher Re’s range of $3 billion to $6 billion announced prior to landfall, and reflects the extremely wide swath of the storm’s wind field, which resulted in widespread wind-related damage in Florida and Georgia, and the catastrophic water damage from coastal storm surge inundation and inland flooding.

Despite the severe and far-reaching impacts of hurricane Helene, Gallagher Re’s Bowen states that with a worst-case scenario avoided, Helene does not appear to be large enough of an event to “meaningfully impact the broader re/insurance market.”

Although a powerful Cat 4 storm with 140 mph winds and higher gusts at landfall, the storm’s peak winds did miss the most populated parts of Florida and Georgia, which will help to limit some of the wind-related costs.

However, Bowen does warn that losses to the National Flood Insurance Program (NFIP) will be notable along Florida’s western peninsula, with a multi-billion dollar NFIP loss expected.

Additionally, storm surge and inundation levels hit new heights in parts of Tampa Bay, while other areas, such as from Sarasota to Fort Myers and in the Big Bend were also heavily affected by inundation, notes Bowen.

Of course, loss guidance remains early and is subject to change in the coming days and weeks as more data becomes available, but currently, Bowen expects the total losses from hurricane Helene to be well above the $10 billion mark.

“Very limited flood insurance take-up in far inland areas is going to mean a large portion of damage will be uninsured. NFIP coverage limits (Residential: $250k structure / $100k contents + Commercial: $500k structure / $500k contents) will in many cases mean properties will not be fully insured against incurred damage. The gap between the overall direct economic cost and the portion covered by private / public insurance for Helene will be sizeable; similar to other historical flood-driven hurricane events,” explains Bowen.

As we wrote earlier, catastrophe risk modeller CoreLogic has also released an initial insurance industry loss estimate for Helene, pegging the wind and storm surge losses at between $3 billion and $5 billion, although the flood component excludes NFIP losses and losses from damage to offshore property is also not included in the total range.

This website states: The content on this site is sourced from the internet. If there is any infringement, please contact us and we will handle it promptly.