Global commercial insurance pricing up 3% in Q2: Marsh

- May 8, 2025

- Posted by: Web workers

- Category: Finance

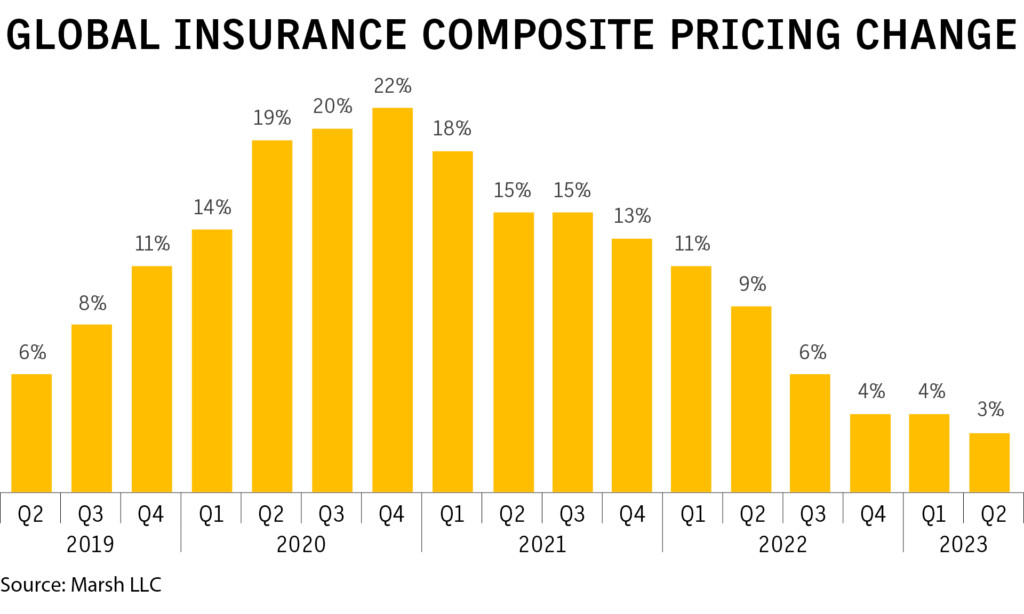

Global commercial insurance pricing rose 3% in the second quarter, compared with 4% in the first quarter and 9% in the second quarter of 2022, according to a report Monday from Marsh.

This year’s second quarter marked the 23rd consecutive quarter in which composite pricing rose, the longest run of increases since the inception of the broker’s pricing index in 2012. Pricing increases peaked at 22% in the fourth quarter of 2020, Marsh said.

Property insurance saw the highest second-quarter price increase globally at 10%, followed by casualty insurance at 3% and cyber insurance, up 1%. Financial and professional lines pricing declined by 8%, following a 5% decline in the first quarter.

Global property and casualty increases matched those of the first quarter, while cyber was down from 11%. Global financial and professional lines pricing declined 5% in the first quarter.

Regionally, the U.S. fell in the middle of the pack, with composite pricing up 4% in the second quarter. The largest composite pricing increase was in Latin America and the Caribbean, up 8%; followed by Europe, up 5%; the Pacific, up 2%; the U.K., up 1%; and Asia, where composite pricing was flat.

U.S. property insurance pricing was up 19%, compared with 17% in the first quarter. Casualty pricing was up 3%, compared with 2% in the first quarter. U.S. financial and professional lines insurance pricing was down 10%, compared with down 9% in the first quarter.

“While the continued moderation in cyber and D&O insurance is a highly positive development for our clients, the continued increases in the property market, specifically property catastrophe, remain an area of concern,” Pat Donnelly, president, Marsh Specialty and Global Placement, Marsh, said in a statement with the report.