Hurricane Milton manageable for reinsurers, but a major event for Florida insurers: Milliman

- June 15, 2025

- Posted by: Saumya Jain

- Category: Insurance

According to Milliman, a global consulting and actuarial firm, hurricane Milton is likely to be a manageable event for the reinsurance industry, but a major one for insurance carriers in the State of Florida and could even put some companies under surplus pressure.

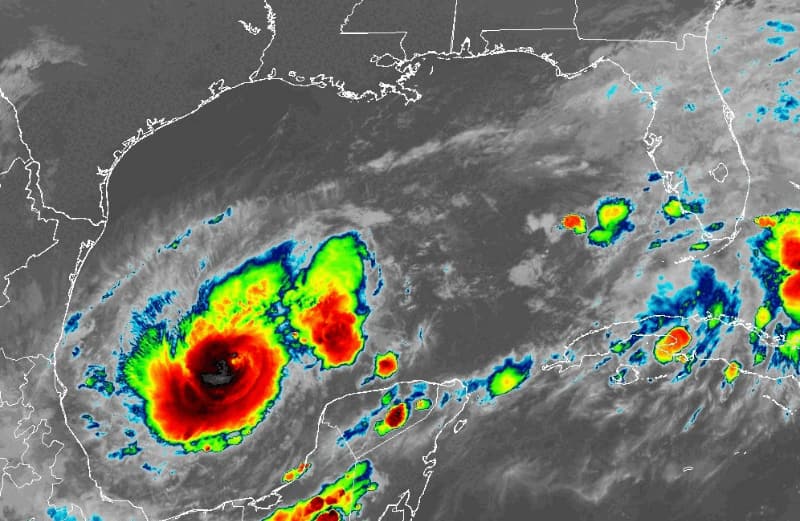

Late on Wednesday, October 9th, hurricane Milton made landfall near Sarasota, Florida, as a Category 3 hurricane with estimated winds of 120 mph.

The storm is likely to result in an insurance industry loss of more than $20 billion, and based on a review of past events, the storm’s physical characteristics, as well as industry information, Milliman has provided an initial post-event range of $20 billion to $40 billion of insured loss.

Although still likely to be the costliest natural disaster of the year, the impacts of Milton could have been far worse were it not for a late shift in the storm’s path away from a Tampa landfall, and the fact a high southwesterly wind shear significantly degraded the strength of Milton as it approached land.

Nevertheless, the fifth US landfalling hurricane of the 2024 Atlantic hurricane season is, according to Milliman, expected to be a major event for Floridian insurers, especially for some of the new companies that entered the market this year.

“For these newer carriers, and for any Florida insurer with significant exposure in Hillsborough, Manatee, Pinellas, and Sarasota counties, Milton might represent the largest event in their company’s history,” says Milliman.

The firm expects a number of Florida carriers to incur a full retention of losses up to the attachment point of their reinsurance coverage, as well as additional losses for any slices of the reinsurance layers they chose to retain.

“Milton might put some companies under surplus pressure, although this pressure would have been significantly greater with a worst-case Milton path or if another similar event were to hit Florida later in this hurricane season,” continues Milliman.

But while hurricane Milton is expected to hit several of the lowest layers of Florida reinsurance towers, which typically carry a higher price and are expected to be hit with some frequency, Milliman feels the impacts of Milton will be manageable for the reinsurance sector.

“However, the repeated occurrence of events (Irma, Ian, Milton, and 2018’s Michael) tapping these lower-lying layers over the past decade raises questions about the sustainability of current prices for this coverage.

“In 2022 and 2023, Florida offered state-backed reinsurance for these working layers via the Reinsurance to Assist Policyholders and the Florida Optional Reinsurance Assistance Program; Milton is likely to squeeze the rates of such working layers even further.

“We do not expect material impacts to more remote layers (for the 1-in-50 year storm or higher) across most reinsurance programs,” says Milliman.

For the insurance-linked securities (ILS) space, Milliman expects Milton to be a minor event, helped by the fact ILS capital has retreated from the Florida market in recent times.

“On average, wind-exposed catastrophe bonds over the past two years attach at approximately the 1-in-60 event, a level that should generally be safe from Milton losses. Initial industry sentiment around the catastrophe bond market suggests an expected loss impact of only a few percentage points of total value, and in the absence of further events, many catastrophe bond funds should still finish with an overall net gain for the year,” explains Milliman.

Adding: “We do expect some pockets of the ILS industry, particularly those participating on lower-lying reinsurance layers, are likely to face more tangible challenges when reserving for Milton. These funds may also encounter constraints from locked collateral as the January renewal cycle approaches.”

This website states: The content on this site is sourced from the internet. If there is any infringement, please contact us and we will handle it promptly.