ILS issuance continues to boom after record in 2024

- October 22, 2025

- Posted by: Web workers

- Category: Finance

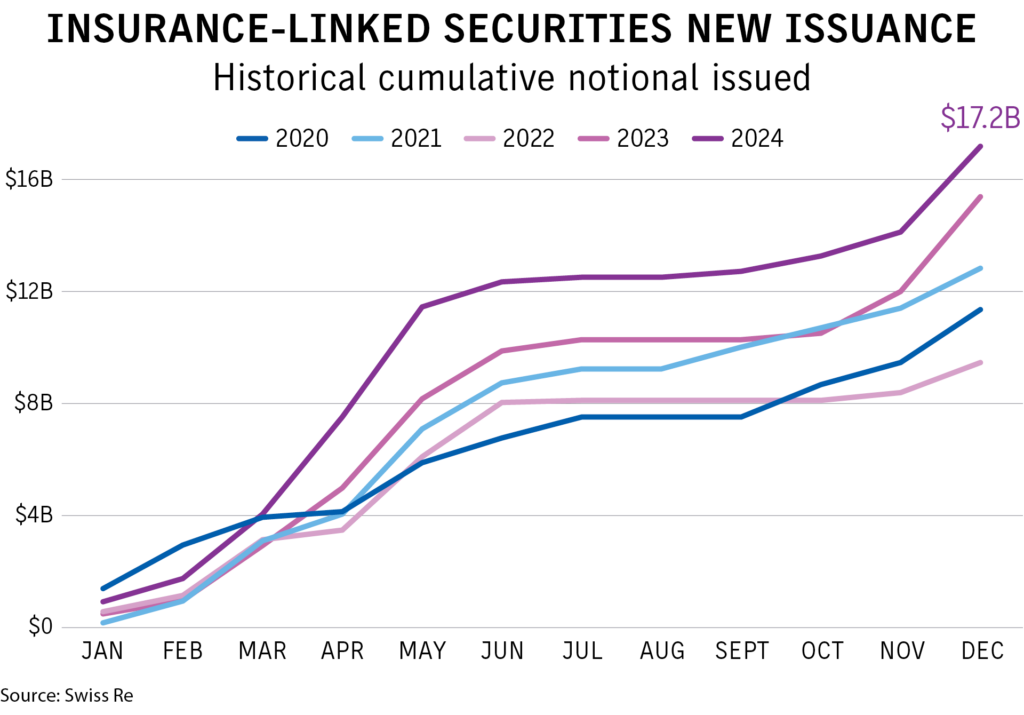

A record $17.2 billion of insurance-linked securities were issued in 2024, driven in part by a host of new sponsors and cedents’ need for additional reinsurance coverage, industry sources said.

The robust fourth quarter, the second most active on record, has provided momentum for the first quarter of this year, which is also seeing more ILS transactions, they said.

“The ILS market has good momentum as evidenced by record issuance in each of the past two years,” said Shiv Kumar, president, GC Securities, the capital markets and ILS unit of Guy Carpenter & Co. LLC.

As inflation drives increases in property values, insurers need to purchase additional reinsurance limits, and some have decided to tap the catastrophe bond market to secure multiyear coverages, he said.

Increased property values coupled with more frequent and severe weather-related catastrophes have made it clear to cedents “that permanent and supplemental sources of capital and risk capacity must be developed beyond traditional reinsurance to manage this volatility,” Mr. Kumar said.

This year “has already started on a very active note, and more transactions were brought to the market this January than any in the past,” he said.

Demand has increased as more insurers look to incorporate the cat bond market into their reinsurance purchasing strategy, said Jason Bolding, Jupiter, Florida-based global head of sales and distribution at Gallagher Securities, a division of Gallagher Re.

“We believe this will continue, and, in fact, we are working with a number of sponsors who are considering their first issuance,” he said.

“Barring any market-disrupting cat event, we expect further growth of the overall market in 2025 as the recent performance of the market continues to attract new inflows and coupon returns, and maturing capacity is generally reinvested,” said Len Zaccagnino, New York-based director ILS Sales for Swiss Re Capital Markets, a unit of Swiss Re Ltd.

In addition, the issuance pipeline for this year remains strong, Mr. Zaccagnino said.

Cedents are looking to augment their reinsurance programs, and 2023 and 2024 were the strongest two years for investor returns in the sector’s history, said Richard Pennay, New York-based CEO of Aon Securities, a unit of Aon PLC.

“Heading into 2025, we have these really strong dynamics where investors now have received really strong returns for two years in a row, and we also have our clients looking to expand their overall reinsurance,” he said.

Aon expects the first and second quarters to be active, Mr. Pennay said.

“Although it’s very early in the year, we anticipate that by the end of 2025, we may be looking at the third year in a row of record issuance,” said Mr. Bolding of Gallagher. “The new issue pipeline is in full swing, and it doesn’t seem to be slowing down.”

Global reinsurance capital grew to $715 billion as of Sept. 30, 2024, up 6.7% from the end of 2023 and 24.3% from the end of 2022, according to Aon. About $113 million of that total is now alternative capital, the broker’s figures show.

New sponsors helped drive the record 2024 issuance, with nine in the first half of the year and three in the second. The largest transaction sponsored by a new entity was Tower Hill Insurance Group’s Winston Re 2024-1, providing $400 million of coverage for Florida windstorm risk.

There will continue to be new sponsors, which could include governments, said Jeff Mohrenweiser, Chicago-based senior director of global securities for Fitch Ratings Inc.

“Fitch believes the record issuances in 2023 and 2024 will continue into 2025,” he said.

Mr. Pennay also noted the influx of new sponsors, which he said ranged from U.S. companies to the Government of Puerto Rico. To date, just over 100 ceding entities have tapped the capital markets for reinsurance coverage, he said.

The record total issuance last year was also bolstered by the addition of cyber risk as a peril covered by the capital markets, although cyber cat bonds are still nascent and much smaller than those related to wind and earthquake perils.

“The number of deals that are being brought to the market is increasing, but the dollar volume is still a very small percentage of the larger property-cat perils,” Mr. Mohrenweiser said.

“Investors continue to work to better understand cyber and cyber exposures,” giving cyber cat bonds the chance to “become pretty meaningful as we move forward,” Mr. Pennay said. “In the years to come, cyber will most likely become increasingly interesting.”

More growth is expected in the cyber ILS market, said Brittany Baker, New York-based vice president of solution consulting at CyberCube.

“The introduction of the first cyber cat bonds demonstrated that there are parties on both sides of the transaction that find value,” she said.