M&A activity reverts to pre-2021 levels

- July 28, 2025

- Posted by: Web workers

- Category: Finance

Deal activity in the insurance distribution sector has come full circle, and 2023 can be characterized as a return to normal.

The total number of transactions last year was 782, compared with 1,030 in 2022 and 1,108 in 2021, marking declines of 24% and 29%, respectively. Yet, compared with the average of the three-year period prior to 2021-2022, last year’s deal count was 11% higher.

These totals include U.S. and Canadian property/casualty and employee benefits brokerages, third-party administrators, managing general agent operations, life insurance/investment or financial management, consulting, and other business connected to insurance distribution. We collect the information from public announcements, buyer websites and other sources in a consistent manner from year to year, but it does not include all transactions, as many are never disclosed publicly.

<div align=”center”><a rel=”gallery” class=”fancybox” href=”https://www.businessinsurance.com/assets/pdf/BI_0224_06C.png”><span class=”rsrch_img” style=”background:white !important; width: 480″>

<img src=”https://www.businessinsurance.com/assets/pdf/BI_0224_06C.png” width=”480″></span></a></div>

This past year saw very steady M&A activity, with 185 to 204 deals per quarter. There was no fourth-quarter surge, as had been seen in the three previous years. The last time the industry saw similar steady experience was in 2019.

The 406 reported transactions in the second half of 2023 were 8% higher than in the first half of the year but 27% below the second half of 2022 and 17% below the previous five-year second-half average. For the year, 2023 was 8% below the previous five-year average. Evidence suggests the overall rate of decline is slowing.

A deeper look at historical trends shows that the first half of 2023, with 376 transactions, was 19% greater than the average first half in the “pre-bubble” years, and the second-half total was 5% greater.

The figures reflect a normalized interest rate environment, a still sizeable number of buyers active in the industry and the continued aging of the ownership base of selling companies, whose value on the street continues to be far greater than the internal value to the next generation of owners.

Buyers are broken down into the following categories:

- PE/hybrid — Private-equity backed and private firms with significant outside acquisition financial support

- Publicly traded

- Privately owned

- Bank-owned

- Others

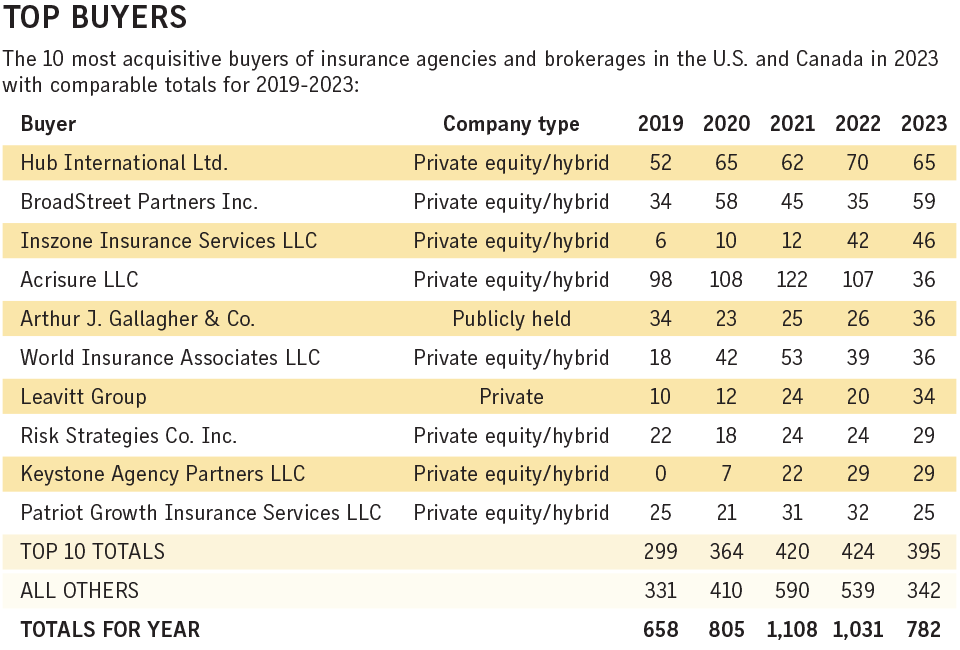

The most active buyer list changed notably in 2023, as the perennial most frequent buyers, Acrisure LLC and PCF Insurance Services, were no longer at the top. Hub International Ltd., with 65 transactions topped the list; the brokerage consistently completes 60 to 70 deals per year. Broadstreet Partners and Inszone Insurance Services, each with 46 transactions, followed Hub. Broadstreet remains a consistent acquirer, while Inszone is relatively new on the scene.

The surge of M&A activity in the insurance distribution sector has been largely a story of private-equity-driven activity. PE/hybrid remains the most-active group of buyers, accounting for eight of the top 10 spots and 47% of all agency acquisition transactions. Arthur J. Gallagher & Co. and Leavitt Group, publicly traded and privately-owned, respectively, were also active acquirers. Including their deals in the Top 10 yields 56% of the deals. The top 10 buyers each year in the recent past generate approximately 50% to 55% of the industry’s total deals. Of the top 10 buyers, Broadstreet Partners, up 24, Leavitt Group, up 14, and Gallagher, up 10, led the group with the largest increases in deal activity. Acrisure, down 71, and Highstreet Partners, down 20, showed the largest declines.

<div align=”center”><a rel=”gallery” class=”fancybox” href=”https://www.businessinsurance.com/assets/pdf/BI_0224_06B.png”><span class=”rsrch_img” style=”background:white !important; width: 480″>

<img src=”https://www.businessinsurance.com/assets/pdf/BI_0224_06B.png” width=”480″></span></a></div>

The 25-month spike, from December 2020 through December 2022, in M&A activity provided a study of a consolidating industry meeting up with seller concerns over increases in capital gains rates and pending interest rate increases, both of which would reduce valuations. With those two issues in the rearview mirror, it should have been no surprise that 2023 deal activity would revert to the historic mean.

Some other statistics from the 2023 activity:

- 34 different PE/hybrid buyers acquired a combined 543 agencies in 2023, an average of 16 transactions each; three PE/hybrid buyers made their first acquisition in 2023.

- There were 66 privately owned companies that acquired a combined 167 agencies, compared with 63 that bought 199 agencies in 2022, an average of 2.5 and 2.7, respectively.

- 64 companies acquired only one agency in 2023, while 30 acquired five or more.

- There were 51 first-time buyers in 2023.

Property/casualty brokers continued to dominate the sell side, accounting for 60% of the total. Employee benefits brokers were the second most acquired companies in 2023, representing 13% of the total.

The return to historic norms in the volume of M&A transactions should continue as economic forecasts no longer include warnings of recession and interest rates remain relatively stable, the investor world still has tremendous sums to put into play, and there continues to be a large number of business owners unable or unwilling to sell to the next generation inside the company. We expect overall transaction volume to remain the same throughout 2024, with perhaps more large transactions along the lines of Aon PLC’s planned acquisition of NFP Corp.

Steve Germundson, Timothy Cunningham and Daniel Menzer are principals at Optis Partners LLC, a Chicago-based investment banking and financial consulting firm that serves the insurance distribution sector. Mr. Germundson can be reached at [email protected] or 612-718-0598; Mr. Cunningham can be reached at [email protected] or 312-235-0081; and Mr. Menzer can be reached at [email protected] or 630-520-0490.