Multiple factors hinder insurance protection gap collaboration, reveals poll

- July 20, 2025

- Posted by: Kassandra Jimenez-Sanchez

- Category: Insurance

In 2024, economic losses from natural disasters exceeded $300 billion for the ninth consecutive year, and while insured losses were also high, the persistent protection gap, estimated at 60%, underscores the urgent need for comprehensive solutions in both developed and emerging markets.

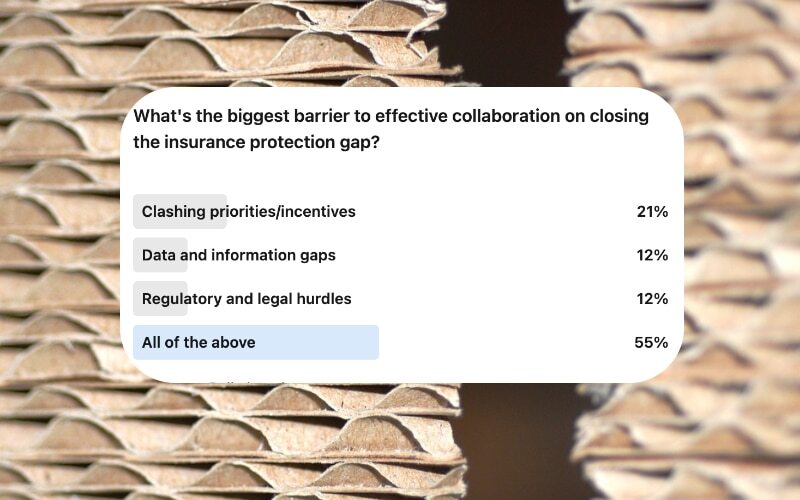

Analysts emphasize that collaborative efforts are paramount to effectively address this widening gap. A recent poll conducted by Reinsurance News sought to identify the primary barriers to such collaboration.

The poll revealed that 21% of participants believe that clashing priorities and incentives are the biggest obstacle, while 12% pointed to data and information gaps, and another 12% highlighted regulatory and legal hurdles.

However, a significant 55% of participants believed that the largest barrier is a combination of all these factors, demonstrating the multifaceted nature of the challenge.

Just in 2024, economic losses caused by natural disasters reached $368 billion, with only $145 billion covered by insurance, leaving a protection gap of $223 billion, according to data from re/insurance broking group Aon.

Notable events included Hurricane Helene, which struck the United States in September, causing an estimated $75 billion in damages and tragically resulting in 243 fatalities, marking it as the year’s costliest global event.

Additionally, Hurricane Milton in October accounted for the single largest insured loss event globally, with losses totalling $20 billion.

In Europe, escalating rainfall frequency and severity have made flood insurance increasingly difficult to obtain.

Only a small fraction of the economic losses from these so-called secondary peril events are typically insured. For instance, recent large-scale wildfires in California saw only approximately 25% of losses covered, according to broker Howden’s estimates.

However, Howden analysts highlighted that narrowing the protection gap is possible through “old-fashioned collaboration” by strengthening the bond between regulators, insurers, and homeowners.

David Howden, Founder and CEO of Howden, explained: “That means regulators giving carriers the flexibility to increase their prices – so they’re not forced to pull out of the market and homeowners can get the coverage they need.

This website states: The content on this site is sourced from the internet. If there is any infringement, please contact us and we will handle it promptly.