New ILS issuance hits record level in 2024: Swiss Re

- October 23, 2025

- Posted by: Web workers

- Category: Finance

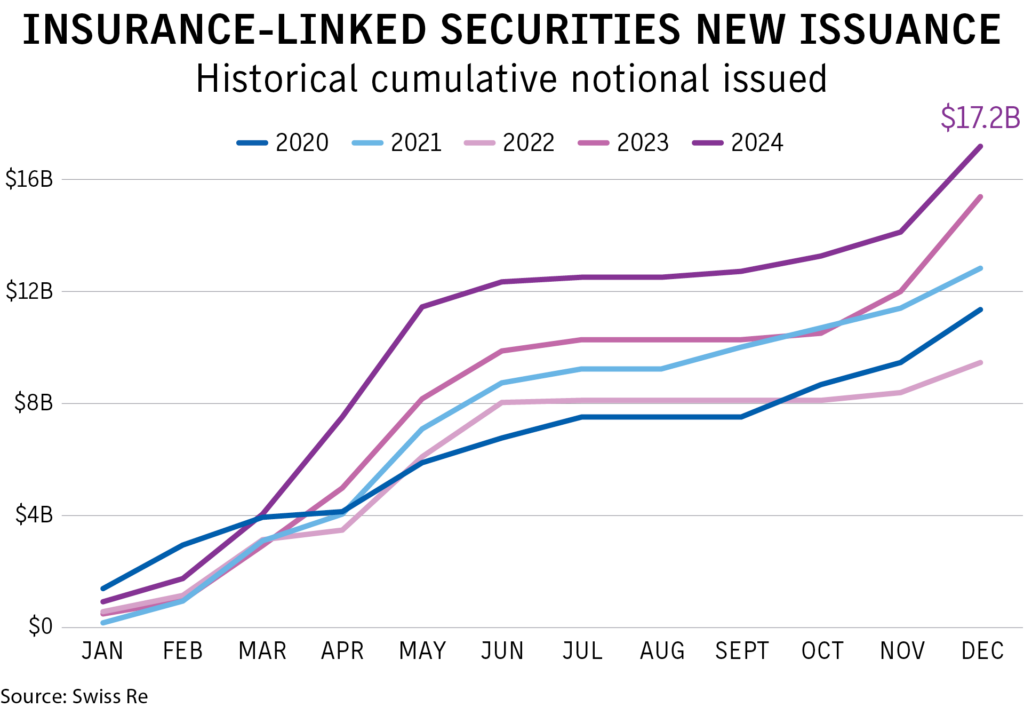

There was an estimated $17.2 billion of new issuance in the insurance-linked securities market in 2024, topping the previous record of nearly $16 billion in 2023, according to a report Tuesday from Swiss Re Capital Markets, a unit of Swiss Reinsurance Company Ltd.

There was $12.3 billion of new issuance during the first six months of 2024, more than in any full year except 2021 and 2023, the report said.

Following the typical pause for U.S. wind season, the ILS market resumed its active pace with $4.4 billion in new issuance in the fourth quarter, the second highest fourth quarter, after 2003’s $5.1 billion, despite the disruptions of Hurricanes Helene and Milton.

As of early December, the Swiss Re Institute estimated the insured losses from both hurricanes to be below $50 billion, and their impacts on the ILS market have been minimal to date, Swiss Re said.

The ILS market continues to be dominated by U.S. perils, mainly wind, with some 60% of 2024 issuance having more than 90% of expected loss contribution from U.S. wind on a modeled basis, the report said.

New sponsors helped drive the total, with nine in the first half of the year and three in the second, according to report data. The largest of these was Tower Hill Insurance Group’s Winston Re 2024-1 providing $400 million of coverage for Florida windstorm.

The market for insurance-linked securities backing cyber insurance, the first of which was issued in late 2023, continued to grow, said Swiss Re, further bolstering the record issuance.

While final totals are still being tallied, in early December, Swiss Re Institute published an estimate that insured losses from natural catastrophes in 2024 were on track to exceed $135 billion, topping the $100 billion mark for the fifth consecutive year.