Perspectives: Broker M&As slow slightly in 2025 first half

- July 21, 2025

- Posted by: Web workers

- Category: Finance

Mergers and acquisitions among North America’s insurance agents and brokers eased in the first half of this year, albeit at a slower rate than recent periods, and is slightly above levels last observed in 2020.

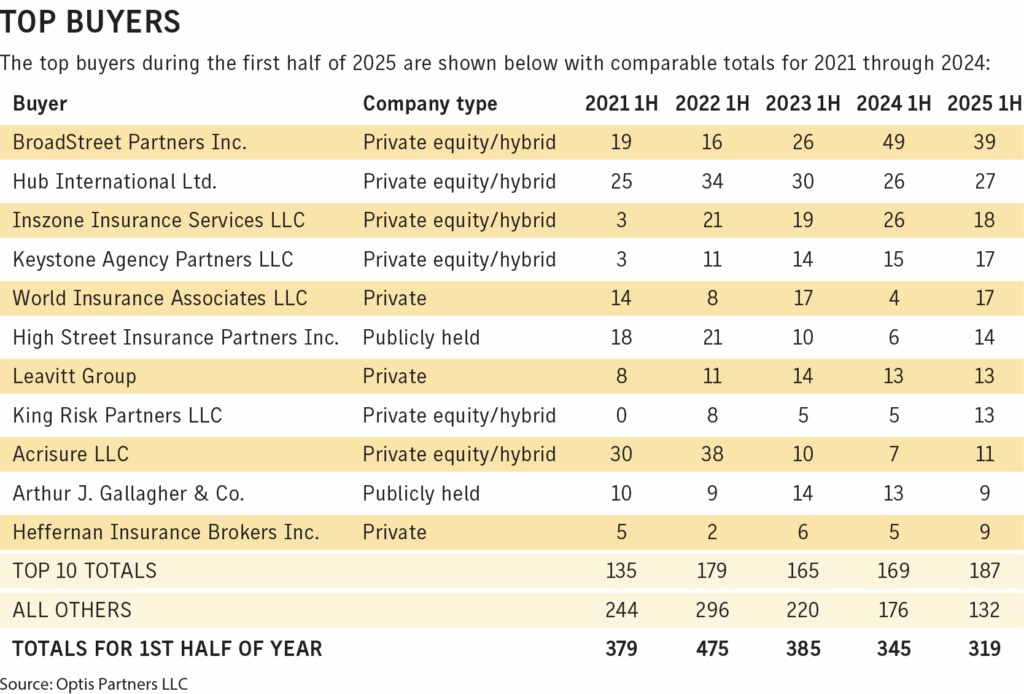

While the pace is off only slightly over the past year, the makeup of active buyers is in flux. Leading buyers such as Broadstreet Partners Inc. and Inszone Insurance Services continue to be at or near the top of the list of the most active, although their pace of deal activity has slowed. Other leaders, such as High Street Insurance Partners, King Risk Partners, and World Insurance Associates LLC, are still near the top and their pace has accelerated.

The total number of U.S. and Canadian transactions involving property/casualty agents and brokers, benefits brokers, managing general agents and third-party administrators during the first half of this year fell 8% to 319 from 345 during the same period last year and was 16% below the previous five-year average.

There were 168 transactions during the second quarter, down 6% from the same period in 2024. On a trailing 12-month basis, the latest deal count was 758, only 3% lower than all of 2024 and 5% lower than the prior trailing 12-month period.

Among the sellers in the first half, 65% were retail property/casualty agencies, 13% were employee benefits specialists, and 8% were classified as selling both. The remaining 14% of sellers comprise companies on the wholesale side of distribution, third-party administrators, life insurance agencies, financial products sellers, and a variety of consulting businesses related to insurance distribution.

Companies backed by private equity continue to dominate the deal-making landscape, and we do not foresee this changing for many years to come. These buyers accounted for 73% of the transactions so far this year, which is similar to past experience. Privately owned companies accounted for 19% of deals.

Perennial front-runners BroadStreet and Hub International Ltd. continue to close the most transactions, reporting first-half deals of 39 and 27, respectively. While Hub’s pace was one deal higher than the same period last year, it was 6% below its average in the previous five years. BroadStreet’s activity decreased 20% in the first half but is 39% above the previous five-year average. Among the remaining top 10 most-active buyers, World Insurance, King Risk Partners and HighStreet Insurance Partners Inc. more than doubled their deals closed over the same period in 2024. Inszone and Arthur J. Gallagher & Co. each slowed their pace by nearly a third.

In total, the 10 most active buyers — including ties — booked 59% of the announced transactions so far in 2025, and the top 25 buyers booked 82%. In total, 37 buyers made more than one transaction in the first half, and 16 reported making their first acquisition.

So far in 2025, large transactions include Gallagher’s acquisition of Woodruff Sawyer and Alera’s purchase of Kaplansky Insurance Agency. Large deals announced but not yet completed include Gallagher’s acquisition of AssuredPartners Inc., announced in December 2024, and Brown & Brown Inc.’s acquisition of Accession Risk Management Group, which includes Risk Strategies and One80 Intermediaries, announced in June 2025. Both of these deals are expected to close in the 2nd half of 2025.

A constant force driving M&A in the industry is the large amount of capital pursuing investment opportunities, reflected by the 189 unique buyers since the beginning of 2023. In this same period, 49 private-equity investors have completed deals, 32 of which have done four or more deals, while ten have done just one. In the same period, privately-owned firms announced 110 deals, with 20 announcing four or more, and 73 having done just one.

We believe the deal volumes witnessed today can be expected to continue. While more exceptionally large transactions will be announced as the largest firms chase meaningful growth, the average size of the acquisitions will decline.

Steven E. Germundson, Timothy J. Cunningham and Daniel P. Menzer are principals at Optis Partners LLC, an investment banking and financial consulting firm in Chicago and Minneapolis that serves the insurance distribution sector. Mr. Germundson can be reached at 612-718-0598 or [email protected]; Mr. Cunningham can be reached at 312-235-0081 or [email protected]; Mr. Menzer can be reached at 630-520-0490 or [email protected]