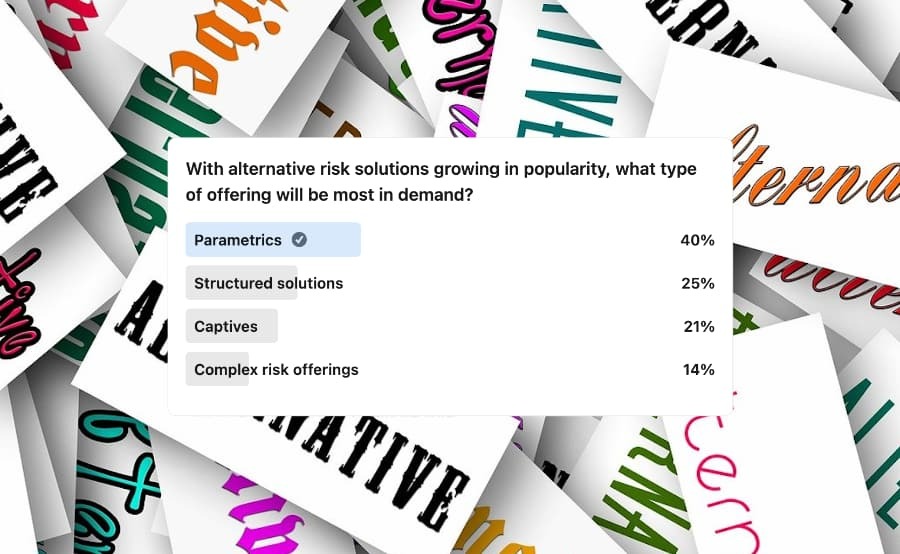

Poll suggests parametrics rank as most in-demand alternative risk solution

- August 25, 2025

- Posted by: Beth Musselwhite

- Category: Insurance

As alternative risk solutions gain traction, parametric insurance is expected to be the most in-demand offering, according to a recent poll by Reinsurance News.

The poll shows that parametrics lead significantly with 40% of the vote, far surpassing structured solutions at 25%, captives at 21%, and complex risk offerings at 14%.

The growing popularity of parametric insurance is in part to its ability to provide swift and reliable financial protection against emerging risks.

Unlike traditional insurance, which pays out based on the actual loss incurred, parametric insurance offers coverage that guarantees a payout based on predefined events.

An independent third party evaluates the event’s intensity, and if it meets the agreed trigger, the policyholder automatically receives a predetermined payout. This method is effective as it ensures prompt financial support without a lengthy claims process.

Despite its advantages, a previous poll conducted by Reinsurance News reveals that several obstacles still hinder the global adoption of parametric insurance. These challenges include a lack of available data and models, as well as inadequate education about these solutions. Addressing these issues is crucial for unlocking the full potential of parametric insurance.

Structured solutions, which ranked second in demand, are customised, non-traditional reinsurance programs designed to manage risk volatility over multiple years.

They offer benefits such as tailored coverage, stability in volatile markets, cost-effectiveness over time, and inclusion of difficult-to-find coverages.

However, structured solutions come with some drawbacks, which may explain their lower ranking compared to parametric insurance. These include a lengthy structuring process that can add complexity. Additionally, if loss activity exceeds expectations, these solutions might become more expensive, and they still require traditional insurance to supplement them.

Closely following structured solutions (25%) were captives (21%). Captives are wholly-owned subsidiary insurers formed to provide risk mitigation services for their parent company or related entities.

They offer several advantages, including potential cost savings, tax benefits, greater control over coverage and claims, and the opportunity to earn underwriting profits.

However, captives also come with drawbacks, such as the risk to the company’s capital, the potential for being underinsured, overhead expenses and startup costs, and possible compliance issues.

Complex risk offerings, which ranked fourth, are products designed to address particularly intricate or challenging risks. These products are intended for situations where traditional re/insurance solutions may fall short due to the complexity of the risk involved.

This website states: The content on this site is sourced from the internet. If there is any infringement, please contact us and we will handle it promptly.