Primary insurers to cover most Helene losses: Guy Carpenter

- September 29, 2025

- Posted by: Web workers

- Category: Finance

Primary insurers are expected to bear most of the losses from Hurricane Helene, which will likely not exceed $10 billion, Guy Carpenter & Co. LLC said in a report Friday.

Helene could become one of the top 10 largest losses for the federally funded National Flood Insurance Program, Guy Carpenter said.

The vast majority of wind losses will likely be retained by primary insurers, rather than ceded to reinsurers, the reinsurance broker said.

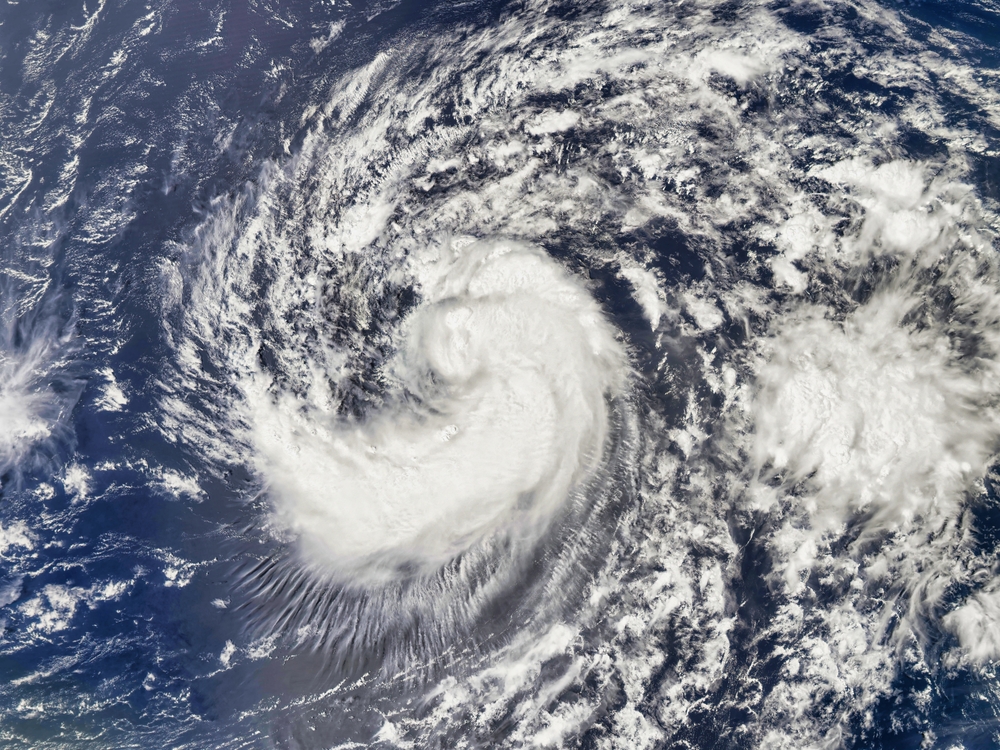

The eye of Helene, which made landfall Thursday night as a Category 4 major hurricane near Perry in the sparsely populated Big Bend region of Florida, passed just east of Tallahassee, which likely rules out insured losses in excess of $10 billion, excluding NFIP losses, Guy Carpenter said.

The record forward speed of Helene at landfall will result in “meaningful inland insured wind losses,” Guy Carpenter, a unit of Marsh LLC, said. Helene had maximum sustained wind of around 140 mph at its height.

Ratings agency A.M. Best said Friday it expects insured losses from Helene of around $5 billion.

“Primary insurers are likely to bear the brunt of the losses given that attachment points have increased over the last couple of years,” Best said.

Losses could creep into reinsurance layers depending upon the ultimate impact of the storm, Best said.

The actual magnitude will depend on flood damage versus wind damage, and business interruption losses based on the length of power outages, repair costs, and demand surge, Best said.

About 4 million people are without power across Florida, Georgia and South Carolina, based on news reports. At least 25 fatalities have been reported so far.

Despite lower take-up rates for flood insurance north of Tampa, NFIP take-up rates in the Tampa Bay region will likely result in a top 10 loss for the program, Guy Carpenter said.

Locations south and east of Helene’s landfall near Perry through the Tampa Bay metropolitan region achieved record coastal storm surge levels, breaking records by 2 to 3 feet, it noted.

Insured losses will be easily absorbed by the insurance industry, credit rating agency DBRS Morningstar said in a report issued Thursday.

Initial estimates for Hurricane Helene point to insured losses in the $3 billion to $5 billion range, Morningstar analysts said.

By comparison, a Category 3 or 4 hurricane making landfall in the Tampa metro area would generate “materially higher losses,” Morningstar said.

Total economic and insured losses from Helene may reach into the billions of dollars, though it’s too early to determine exact loss estimates, Aon PLC said in a report Friday.

Significant flash flooding is currently ongoing across the southeast U.S., with Florida, Georgia, and the Carolinas among the worst impacted, Aon said.

The most recent forecast from the National Hurricane Center said flash flood emergencies are in effect for metro Atlanta and much of upstate South Carolina and western North Carolina. Helene weakened Friday to a tropical storm with maximum sustained winds near 45 miles per hour.

Helene is expected to produce total rain accumulations of 6 to 12 inches, with isolated totals around 20 inches, over parts of the southeastern U.S. into the southern Appalachians, Acrisure Re said in a report Thursday.

“This rainfall will likely result in catastrophic and potentially life-threatening flash and urban flooding, along with significant river flooding. Numerous significant landslides are expected in steep terrain across the southern Appalachians,” Acrisure Re said.

Helene is the ninth major hurricane to make landfall in Florida since 2000 and the third hurricane to make landfall in the Big Bend region in the last 13 months, Aon said. It follows Hurricane Debby in September and Hurricane Idalia in August last year.

Hurricane Idalia caused around $2.5 billion to $4 billion in insured losses, according to Verisk Analytics Inc.