Re/insurers well placed to absorb Helene & Milton losses of up to $54bn: Aon

- October 14, 2025

- Posted by: Luke Gallin

- Category: Insurance

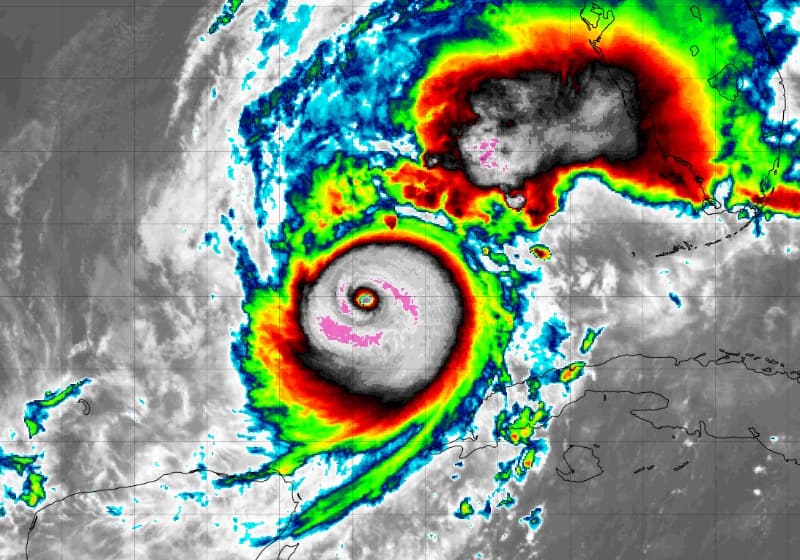

Global insurance and reinsurance broking group Aon feels that “healthy” and “well-capitalized” insurance and reinsurance markets are positioned to absorb industry losses of between $34 billion and $54 billion from hurricanes Helene and Milton.

While the impacts of hurricanes Helene and Milton in Florida and beyond will likely be a challenge for some smaller domestic carriers, ultimately, insured losses were less than first feared, albeit still sizeable at up to $54 billion for both events, according to estimates by Aon’s Reinsurance Solutions.

Prior to the two storms making landfall in Florida just 13 days apart, there was some expectation that rates for property catastrophe reinsurance would fall at the January 1st, 2025, renewals, but given the fact insured loss estimates are trending lower than once feared and the strong capitalisation of the insurance and reinsurance sectors, the consensus has since shifted.

Similarly, in the aftermath of Milton, some industry analysts suggested that property cat rates could harden further at 1.1, but the expectation from Aon is for a steady renewal landscape next year.

“The short-term prospect of a return to harder market conditions is unlikely, and the 2025 renewal environment is expected to remain stable,” says Aon.

Ultimately, Aon feels that both primary insurance and reinsurance markets are well-placed to handle losses from the two hurricanes, and predicts a continuation of the moderating property insurance market in 2025, at least in the short term.

Highlighting the robust capitalization of both sectors, Aon notes that total direct industry policyholder surplus stood at $1.1 trillion, as of June 30th, 2024, according to the firm’s analysis of S&P Global Market Intelligence data.

At the same time, global reinsurer capital levels reached $695 billion at the mid-point of 2024, which, according to Aon, means that reinsurance losses from both events will be manageable, with metrics suggesting a stable reinsurance market into next year.

Tracy Hatlestad, executive managing director and global property segment leader with Aon’s Reinsurance Solutions, said: “As a result of rate increases and retention resets in the reinsurance market in 2023, ceded losses to reinsurers from Milton are expected to produce industry loss ratios near their planned levels.”

Vincent Flood, head of U.S. Property, Aon, added: “Clients with heavy Florida and Gulf Coast exposure concentrations may be slightly more challenged, however, we expect the moderating property market to continue, especially for well-performing risks. We believe markets will continue to be aggressive through the remainder of 2024 and into 2025.”

This website states: The content on this site is sourced from the internet. If there is any infringement, please contact us and we will handle it promptly.