Reinsurance renewals show pricing reductions

- July 5, 2025

- Posted by: Web workers

- Category: Finance

April 1 reinsurance renewals showed a continuation of the market conditions at January 1 renewals with reinsurers deploying added capacity leading to pricing reductions for cedent insurers, Aon PLC said in a report Tuesday.

Property reinsurance in the U.S. renewed across a wide range of outcomes, with loss-free policies flat to down 15% while loss-hit accounts were flat to up 20%, according to a separate report Wednesday from Gallagher Re, the reinsurance business of Arthur J. Gallagher & Co.

Property reinsurance renewals across Asia were largely down, as much as 30% for catastrophe loss-free policies in Korea, with renewals in Japan and the Philippines mostly down in the low single-digit percentages.

Latin America and the Caribbean, meanwhile, saw property reinsurance renewals increases as high as 20% for loss-hit accounts.

U.S. casualty reinsurance renewed across a tighter range than property, with loss-free accounts down 5% to up 5% while loss-hit accounts renewed flat to up 10%, according to the Gallagher Re report.

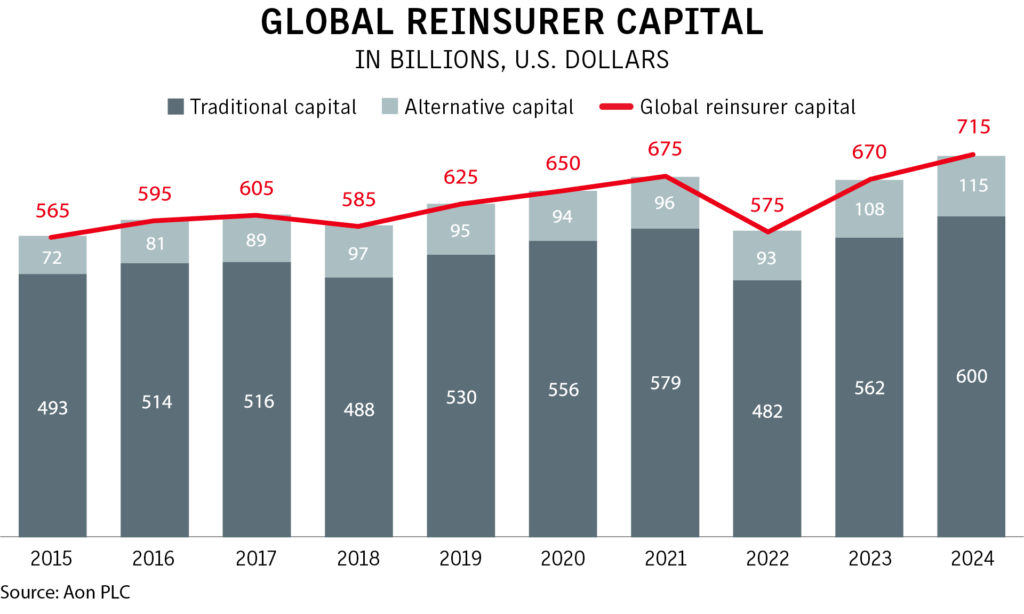

Global reinsurer capital rose by $45 billion to $715 billion during 2024, driven primarily by retained earnings, Aon said, giving reinsurers additional capital to deploy.

Alternative capital is estimated to have reached a new high of $115 billion at the end of 2024, up $7 billion in the year. The catastrophe bond reached the $50 billion milestone in March 2025 while the broader ILS market has seen further growth in sidecar capital as well, according to Aon.