Reinsurers should remain strongly profitable in 2025: Fitch

- May 17, 2025

- Posted by: Web workers

- Category: Finance

Global reinsurers’ profitability is forecast to remain strong in 2025 despite markets being broadly down in the mid to high single-digit percentages at Jan. 1 renewals, according to a report Thursday from Fitch Ratings Inc.

Although the reinsurance cycle is now past its peak, according to Fitch, “market conditions remain supportive of strong risk-adjusted returns,” the ratings agency said.

“Despite the rate reductions, we expect the sector’s premium income to increase in 2025, driven by higher volumes,” Fitch said.

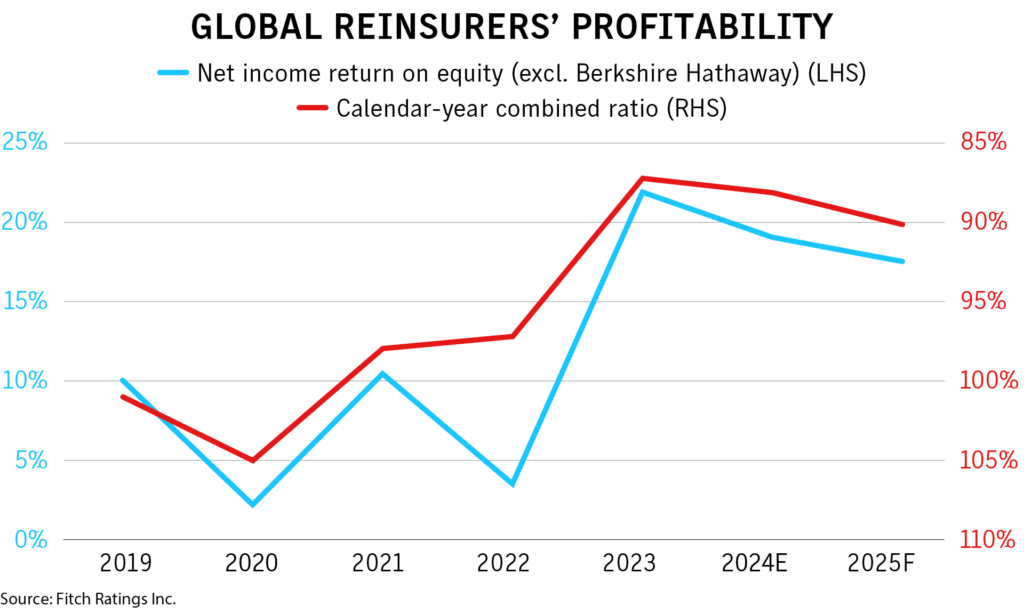

Reinsurers’ combined ratios for 2025 should “hover” around 90% while the sector’s return on equity falls slightly to 17% from 19% in 2024.

Fitch said its sector outlook remains ‘neutral’.

The report noted that reinsurance rate reductions were not accompanied by any notable easing in contract terms and conditions, with reinsurers maintaining most of the improvements in structures and attachment points achieved in recent years.

It was also pointed out that despite estimated 2024 insured property catastrophe losses of about $140 billion in 2024, the fifth consecutive year of insured losses above $100 billion, the vast majority of these losses, some 85% to 90%, were absorbed by primary insurers due to the higher attachment points, “a situation that will persist in 2025 as reinsurers stay cautious on secondary peril exposure,” Fitch said.

The severe fires still burning in the Los Angeles area will represent a “significant” portion of reinsurers’ first-quarter 2025 natural catastrophe budgets, but reinsurer ratings are not expected to be affected.

“Any potential impact on pricing at subsequent reinsurance renewals will depend on the ultimate level of reinsured loss and the remoteness of such an event relative to catastrophe loss expectations,” Fitch said of the wildfires.