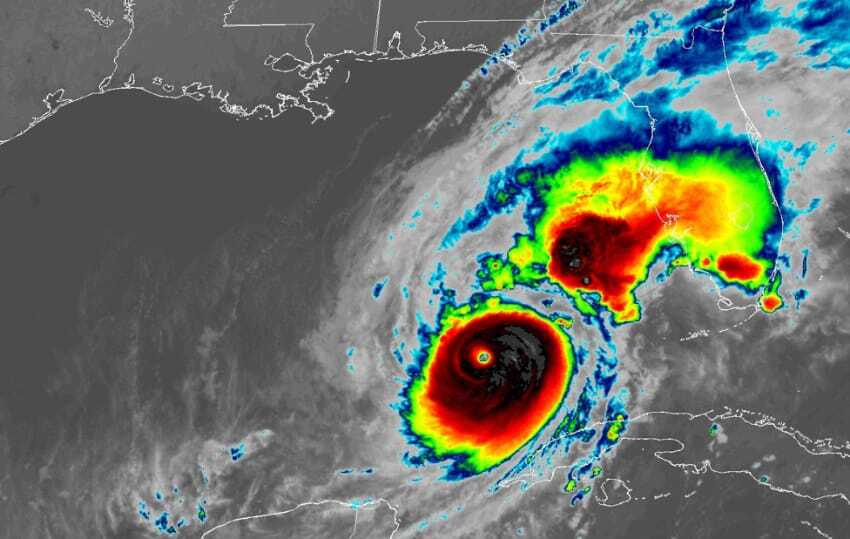

Tampa could avoid direct Hurricane Milton impact, though significant uncertainty remains: Morningstar DBRS

- July 10, 2025

- Posted by: Kane Wells

- Category: Insurance

With the U.S. National Hurricane Center now placing the entry point of Hurricane Milton about 40 miles south of Tampa, Florida, Morningstar DBRS has suggested that insured losses could be “substantial but not catastrophic”, sitting in the $30 billion to $60 billion range, though significant uncertainty remains.

According to Morningstar DBRS, the large metropolitan area of Tampa sits “within the cone of uncertainty” as the storm’s trajectory could change in the hours before it makes landfall.

“Our initial insured loss projections if Hurricane Milton makes direct landfall in Tampa remain in the $60 billion to $100 billion range, potentially making Hurricane Milton’s insured losses on par with those of Hurricane Katrina, which reached $100 billion in today’s dollars and is still considered the costliest natural catastrophe in U.S. history,” Morningstar DBRS said.

The firm continued, “Milton’s destructive path will likely stretch far beyond the Florida coastline in the Gulf of Mexico and will also affect other major urban areas, including Orlando.

“The damage caused by recent storms, including Hurricane Helene, will compound the losses in regions still battling with recovery efforts.

“Nevertheless, the hurricane’s most recent projected path suggests that insured losses will be substantial but not catastrophic.”

Morningstar DBRS anticipates losses with an entry point south of Tampa Bay, but far from Fort Myers, to be in the $30 billion to $60 billion range.

The firm went on, “Regardless of the magnitude of the damage inflicted by Hurricane Milton, the accumulation of insured losses during the 2024 hurricane season, which still has approximately two more months to go, will likely make a dent in insurers’ profitability, particularly to those with significant exposures to personal lines in Florida.”

At the same time, cat bonds and other insured-linked securities reportedly remain subject to losses depending on the entry point, wind forces, and eyewall size.

Still, as per Morningstar DBRS, global reinsurers’ financial strength will “likely remain relatively unscathed” in a scenario where Hurricane Milton does not hit Tampa directly, given the higher attachment points of most reinsurance programs and the reduction in capacity implemented during the hard market of the past few years.

“Even in a scenario of moderate losses, we anticipate that the reinsurance industry will resume its hardening trend with higher rates and stricter renewal conditions in early 2025,” the firm concluded.

This website states: The content on this site is sourced from the internet. If there is any infringement, please contact us and we will handle it promptly.