Tech firms see employment practices rates rise, E&O fall

- September 1, 2025

- Posted by: Web workers

- Category: Finance

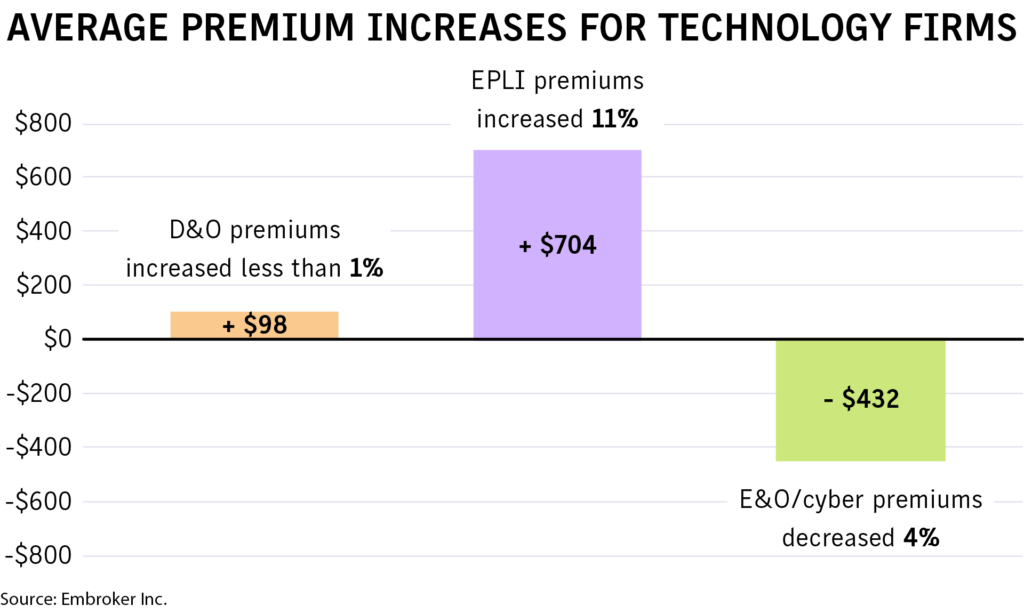

Technology companies saw double-digit increases in employment practices liability insurance last year, while directors and officers liability rates were almost flat, and technology errors and omissions, including cyber, prices fell, according to a report by Embroker Inc.

The San Francisco-based digital brokerage analyzed purchasing data from its customers and found that technology companies buying EPLI coverage paid an average of 11% more last year.

D&O rates inched up 1%, and tech E&O rates fell 4%, the report said.

As EPLI costs rose, companies across the technology sector reduced their limits purchased the report found. In 2024, 93% of data and analysis companies opted for the lowest limit of $1 million, compared with 83% in 2023. 95% of enterprise software companies and health care technology companies bought the lowest limit last year, compared with 89% and 86%, respectively, a year earlier.

Conversely, with falling tech E&O rates, some technology companies increased the limits they bought. For companies with less than $1 million in revenue, 49% bought $1 million in limits, and 20% bought $5 million in limits, compared with 55% and 16%, respectively, a year earlier. For companies with $1 million to $5 million in revenue, 30% bought $1 million in limits, and 37% bought $5 million, compared with 34% and 33%, respectively, a year earlier.

Among companies with revenue of $5 million or more, though, 22% bought $1 million in limits, compared with 17%, and 47% bought $5 million, compared with 48%.

For D&O coverage, 42% of companies with more than $5 million in revenue bought a $1 million limit, compared with 35% in 2023.

Premiums increased significantly for technology businesses that grew last year, the report said. For example, D&O premiums for companies that went from under $25 million in funding to more than $25 million increased 116%. In addition, their EPLI premiums increased 90%, and their tech E&O premiums increased 108%.

“The greatest jump in premiums occurred for companies going from mid-range to largest in size, reflecting the rise in unknowns and potential fallout companies face as they mature,” the report said.