Transactional risk insurance limits, placements up sharply: Marsh

- July 14, 2025

- Posted by: Web workers

- Category: Finance

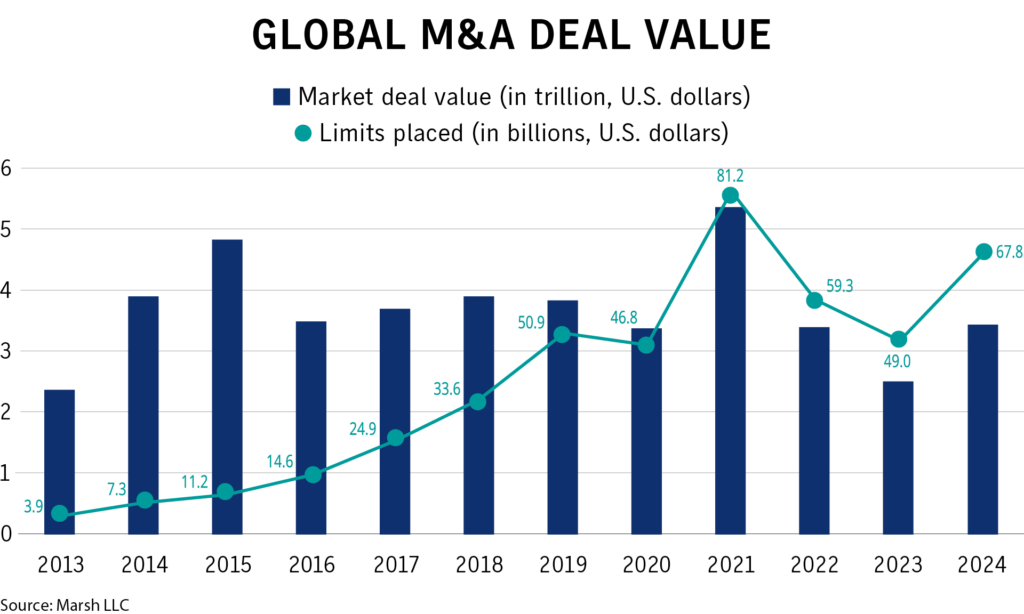

Marsh LLC Monday said it placed transactional risk insurance limits of $67.8 billion in 2024, up 38% from the prior year.

The limits were placed on over 2,750 policies, up 33% from 2023, across nearly 1,600 unique transactions, a 31% increase, according to the Transactional Risk Insurance 2024: Year in Review report released Monday.

Pricing for transactional risk insurance last year was “generally favorable” for buyers, with North America, Latin America and the United Kingdom down 14%; Europe, down 21%; Asia, down 24%; and the Pacific, down 18%.

Representations and warranty insurance rates bottomed out in the second quarter before seeing some modest increases during the latter half of the year due to a rise in demand resulting from more favorable dealmaking conditions, the report said.

Global mergers and acquisitions volume hit $3.4 trillion in 2024, up 8% from 2023’s 10-year low.

Transactional risk insurance claims activity increased “significantly” in 2024, with North America up 20%, Europe up 45% and the U.K. up 70%.

Further growth in the market is expected this year despite some initial headwinds, Marsh said.

“While geopolitical uncertainty has adversely impacted global M&A activity through Q1 2025, we remain optimistic about the continued growth of this market and its role in facilitating successful transactions across various sectors,” Craig Schioppo, global head of transactional risk at Marsh, said in a statement issued with the report.