Verisk estimates Helene’s insured losses could reach $11bn excluding NFIP

- June 19, 2025

- Posted by: Saumya Jain

- Category: Insurance

According to the Extreme Event Solutions group at Verisk, industry-insured losses due to wind, storm surge, and hurricane precipitation-induced flood from Hurricane Helene will range between $6 billion and $11 billion, excluding the National Flood Insurance Program (NFIP).

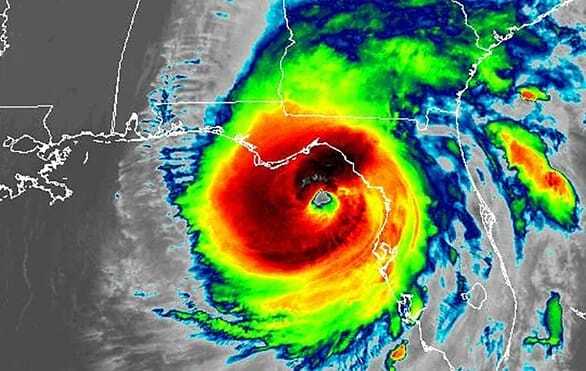

To recap, Helene, a Category 4 storm with 140 mph winds made landfall near the city of Perry in the Big Bend Region of Florida on September 26th.

The storm then weakened while moving northward into Georgia, becoming a tropical storm by the next evening and transitioning to post-tropical later.

Helene is the strongest hurricane to make landfall in the Big Bend region in recorded history. Verisk noted that it caused substantial tree-induced damage from Valdosta up to Augusta and Savannah.

Driven by this, water ingress and debris-induced damages were observed across the eastern portion of the state.

For communities and cities in North and South Carolina, the majority of the damage was related to hurricane precipitation-induced flooding.

Rob Newbold, President, Verisk Extreme Event Solutions, commented, “The devastation and loss of life caused by Hurricane Helene is truly heartbreaking. This event is a reminder to the insurance industry to remain diligent in efforts to learn from and understand the profound impacts of catastrophes.

“The resilience of communities facing such devastating challenges is remarkable and we are inspired by how they have already started to rebuild and prepare for a safer future. We are committed to supporting recovery efforts however we can.”

It should be noted that Verisk’s loss estimates exclude losses exacerbated by storm surge or inland flood, losses paid on wind-only policies due to government intervention, losses to inland marine, ocean-going marine cargo and hull, pleasure boats, uninsured properties, and infrastructure.

According to Fitch Ratings, Florida has the highest proportion of NFIP policies of any state, about 35%. However, in the areas affected by Helene, Verisk predicts that most homeowners will not have flood insurance, given that it is generally not required as these areas are outside of the designated Special Flood Hazard Areas.

Yesterday, Moody’s RMS Event Response estimated insurance industry losses of between $8 billion and $14 billion, while losses to NFIP from Helene will exceed $2 billion.

CoreLogic also recently revised its estimate of total insured losses to between $10.5 – $17.5 billion following the inclusion of losses covered by the NFIP.

Global insurance and reinsurance broker Aon expects industry losses from Helene to be in the higher single-digit billions of USD, with economic losses forecast to be notably higher.

Karen Clark & Company pegged privately insured losses from hurricane Helene at nearly $6.4 billion, although this excludes losses to the NFIP, which are expected to be significant and potentially high enough to trigger its catastrophe reinsurance.

This website states: The content on this site is sourced from the internet. If there is any infringement, please contact us and we will handle it promptly.